Loading

Get Dvat 27a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dvat 27a online

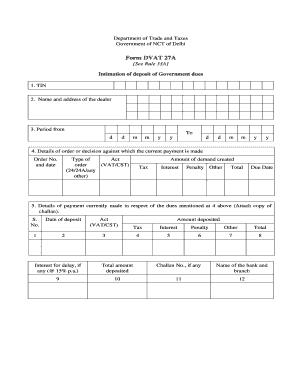

The Dvat 27a form is essential for informing the Department of Trade and Taxes about the deposit of government dues. This guide provides a clear, step-by-step process on how to fill out this form online, ensuring users can accurately complete it for their filing requirements.

Follow the steps to complete the Dvat 27a form online.

- Click ‘Get Form’ button to obtain the Dvat 27a form and open it in your chosen editor.

- Fill in your Tax Identification Number (TIN) in the designated field. This unique identifier is crucial for processing your submission.

- Enter the name and address of the dealer as it appears in your records to ensure proper identification.

- Specify the period from and to, indicating the start and end dates of the filing period using the dd/mm/yyyy format.

- Provide details of the order or decision that necessitated the current payment. Include the order number, date, act type, and the total amounts for tax, interest, penalty, and any other charges.

- Document the current payment being made. Attach a copy of the payment challan and fill out the relevant fields including the date of deposit, act type, and amounts deposited.

- If there are previous payments, detail them by filling out the date of deposit, total amounts for tax, interest, penalty, and any other relevant information.

- Calculate the balance amount of demand left after the current payment and fill it in the provided space.

- Indicate reasons for any non-payment of dues, ticking the appropriate box for either objection, appeal, or any other reason, and specify additional details if necessary.

- Complete the verification section by providing a statement declaring the truthfulness of the information submitted, along with the signature of the authorized signatory, their full name, designation, place, and date.

- Once all sections are filled, review your form for accuracy, then save changes. You can download, print, or share the form as required.

Complete your Dvat 27a form online today for efficient filing of your government dues.

Form 27A of the TDS return is a crucial document that summarizes TDS deductions made during the financial year. It serves as a declaration from the deductor, indicating compliance with tax regulations. Knowing how to use form 27A correctly helps streamline your Dvat 27A reporting process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.