Loading

Get Formular E9 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formular E9 online

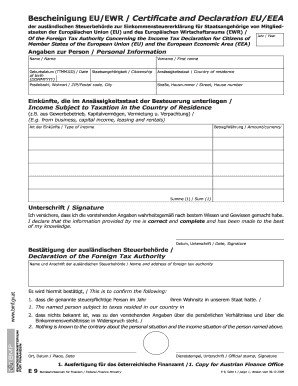

The Formular E9 is essential for individuals from EU and EEA member states declaring income for taxation purposes. This guide provides clear, step-by-step instructions to assist you in completing the form online efficiently.

Follow the steps to complete the Formular E9.

- Click the ‘Get Form’ button to access the Formular E9 and open it in the online editor.

- Fill in the personal information section accurately. Include your name, first name, date of birth (formatted as DDMMYYYY), citizenship, postal code, city, country of residence, street, and house number.

- In the income section, specify the income subject to taxation in your country of residence. You will need to indicate the type of income (e.g., from business, capital income, leasing) and the corresponding amount in the designated currency.

- Calculate the total income and enter this figure in 'Sum (1)'. Be sure to check that all amounts are correct before moving on.

- Proceed to the declaration section. Read the statement ensuring all provided data is true to the best of your knowledge. Then, provide your signature and date the form.

- After completing the form, you have the option to save your changes, download the document for your records, print it if necessary, or share it with the relevant authorities.

Complete your documents online for a seamless experience.

To obtain a tax code in Greece, visit your nearest tax office with the required identification and complete the application process. It is vital to have all necessary documents ready for a smooth experience. Filling out the Formular E9 correctly can also facilitate your tax code application. For expert guidance, check out USLegalForms for supportive tools.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.