Loading

Get Schedule Il Wit 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule IL-WIT online

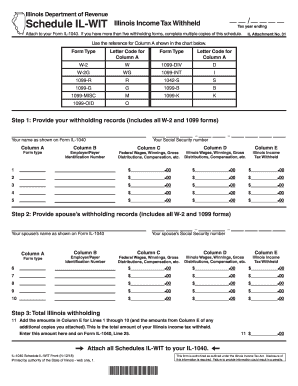

Filling out the Schedule IL-WIT is essential for reporting Illinois income tax withheld. This guide will provide you with clear, step-by-step instructions to complete the form accurately and efficiently online.

Follow the steps to successfully complete Schedule IL-WIT.

- Click 'Get Form' button to obtain the Schedule IL-WIT form and open it in your preferred online editor.

- Begin by entering your withholding records. Include all W-2 and 1099 forms you received. Fill in your Social Security number and your name as shown on Form IL-1040. Next, for each line, provide the appropriate information for Column A (form type), Column B (employer/payer identification number), Column C (federal wages, winnings, gross distributions, etc.), Column D (Illinois wages, winnings, gross distributions, etc.), and Column E (Illinois income tax withheld).

- Continue to fill out the withholding records for your spouse, if applicable. Again, include their Social Security number and name as shown on Form IL-1040, followed by the same information as in step 2 for each line of the schedule.

- Calculate the total Illinois withholding by adding the amounts in Column E for lines 1 through 10. Don't forget to include the amounts from Column E of any additional copies you attached. Enter this total amount on line 11 and also on your Form IL-1040, Line 25.

- Finally, ensure all required Schedules IL-WIT are attached to your IL-1040 before submission. Review the completed form for accuracy.

Complete your documents online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Failing to file your taxes in the States can result in serious financial consequences, including penalties, interest, and potential legal consequences. The IRS and state revenue departments actively pursue individuals who do not file returns. To prevent these issues from arising, consider using Schedule Il Wit to keep your filing on track and compliant.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.