Loading

Get Fha Streamline Worksheet 2020 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fha Streamline Worksheet 2020 online

Filling out the Fha Streamline Worksheet 2020 is an essential step in processing your streamline refinance. This guide provides you with detailed and comprehensive instructions to complete the worksheet efficiently and accurately online.

Follow the steps to complete your Fha Streamline Worksheet 2020 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

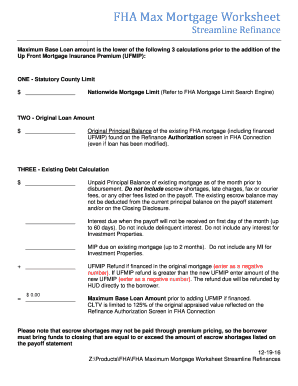

- Locate the section marked 'Maximum Base Loan Amount' where you will determine the lower value of three calculations. Enter the appropriate figures based on the statutory county limit, the original loan amount, and the existing debt calculation.

- For the 'Statutory County Limit,' refer to the FHA Mortgage Limit Search Engine and input the value you find in the designated space.

- For the 'Original Loan Amount,' input the original principal balance of your existing FHA mortgage as found on the Refinance Authorization screen in FHA Connection.

- For the 'Existing Debt Calculation,' aggregate the unpaid principal balance of your existing mortgage with any accrued interest or Mortgage Insurance Premium (MIP) due, ensuring that you do not include escrow shortages or other fees.

- In the provided section for UFMIP Refund, if applicable, enter any potential refund amount as a negative number, making sure it complies with the guidelines mentioned.

- Once you have filled in all necessary fields, review the worksheet for accuracy to ensure all calculations are correct.

- Finalize the process by saving your changes, and opt to download, print, or share the completed worksheet as needed.

Start completing your Fha Streamline Worksheet 2020 online today.

Yes, you can potentially refinance with a credit score of 550, although options may be limited compared to higher scores. Lenders with FHA programs might allow this, provided you meet the minimum down payment requirements. By using the Fha Streamline Worksheet 2020, you can better understand your refinancing possibilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.