Loading

Get How To Calculate Lease Inclusion Amount 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Calculate Lease Inclusion Amount online

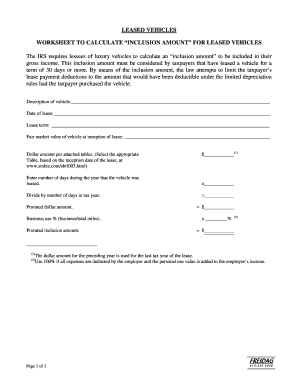

Calculating the lease inclusion amount for leased vehicles is an important process for lessees of luxury vehicles. This guide will provide you with clear, step-by-step instructions on how to fill out the form online, ensuring you meet the IRS requirements effectively.

Follow the steps to accurately complete your form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the description of the vehicle in the designated field. Provide detailed information about the leased vehicle.

- Enter the date of lease in the provided section. Ensure this is the exact starting date of your lease agreement.

- Indicate the lease term in months or years, as specified in your lease agreement.

- Input the fair market value of the vehicle at the inception of the lease. This figure is crucial for calculations.

- Select the appropriate table from the provided URL that corresponds to the inception date of the lease and enter the dollar amount indicated.

- Enter the number of days during the year that the vehicle was leased in the designated box.

- Divide the number of lease days by the total number of days in the tax year to calculate the prorated amount.

- Calculate the business use percentage by dividing business miles driven by total miles driven, and enter it into the form.

- Determine the prorated inclusion amount by multiplying the prorated dollar amount by the business use percentage.

- Review the completed form for accuracy, and save your changes. You may also want to download, print, or share the form as needed.

Begin completing your documents online now to ensure compliance and accuracy.

To calculate lease liability amount, you need to compute the present value of future lease payments. By using an appropriate discount rate, you can accurately assess the liability on your balance sheet. This calculation is pivotal when figuring out how to calculate lease inclusion amount, benefiting both lessee and lessor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.