Get Apers 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Apers online

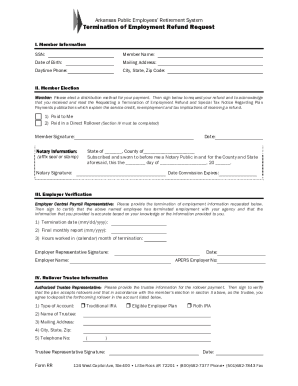

This guide provides comprehensive instructions for completing the Arkansas Public Employees' Retirement System (Apers) Termination of Employment Refund Request form online. By following these guidelines, users can ensure that their forms are completed correctly and efficiently.

Follow the steps to complete your Apers form online.

- Click the ‘Get Form’ button to access the Apers form and open it in the online editor.

- Fill in the Member Information section with your Social Security Number, name, date of birth, mailing address, and daytime phone number.

- In the Member Election section, select your distribution method by choosing either 'Paid to Me' or 'Paid in a Direct Rollover'. Ensure you read and understand the required notices before signing.

- Have the Employer Certification section completed by a representative from your employer's payroll department. This verification confirms your employment has ended and provides necessary termination information.

- If you have chosen a direct rollover, complete the Rollover Trustee Information section with the necessary details from the trustee of your rollover account.

- Once all sections are filled out, review the entire form for accuracy. Save your progress regularly to prevent data loss.

- After finalizing the form, you can save changes, download the completed document, print it for your records, or share it as required.

Complete your Apers documents online today for a smooth refund process.

To calculate the Employee Retirement System (ERS) benefits, similar principles apply as those used in APERS. Determine your service years, average salary, and apply the relevant percentage factor for your specific category. This method provides a clear calculation, informing you of the benefits you could expect during retirement. If needed, you can also utilize the resources available through APERS to gain clarity on this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.