Loading

Get W4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W4 online

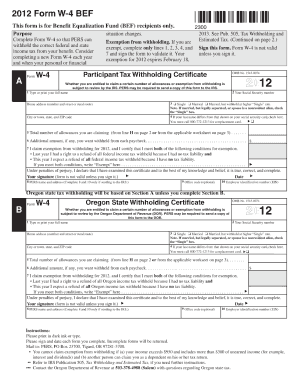

The W4 form is essential for employees to determine the appropriate amount of federal income tax to withhold from their paychecks. Completing this form online simplifies the process and ensures accuracy, allowing users to manage their tax obligations effectively.

Follow the steps to complete the W4 form online with ease.

- Press the ‘Get Form’ button to access the W4 form, opening it in your preferred editor.

- Provide your personal information in Section 1, including your name, address, social security number, and filing status.

- In Section 2, if you have multiple jobs or your spouse works, follow the instructions to calculate your total income and adjust your withholding accordingly.

- Complete Section 3 to claim dependents by providing the necessary information regarding your eligible dependents and calculating the total amount.

- Fill out any additional adjustments in Section 4 for other income or deductions that may apply to you.

- Review all inputted information for correctness and clarity, ensuring that all fields are completed as necessary.

- Once satisfied with the details, save your changes, and utilize options to download, print, or share the completed W4 form as needed.

Take the first step in managing your taxes by filling out the W4 online today!

Typically, the single filing status withholds the most on the W4 form. This means that if you declare single, you can expect a larger portion of your paycheck to be withheld for taxes. However, always consider your unique circumstances, as different situations may lead to different benefits depending on tax credits and deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.