Loading

Get General Liability Questionnaire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the General Liability Questionnaire online

Filling out the General Liability Questionnaire online is an essential step in obtaining liability insurance for your business. This guide will provide you with clear instructions to help you accurately complete each section of the form with confidence.

Follow the steps to successfully complete the General Liability Questionnaire.

- Click the 'Get Form' button to obtain the questionnaire and open it in the appropriate online editor.

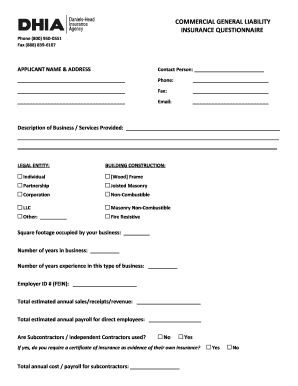

- Fill in the applicant name and address fields with your business's name and physical location.

- Provide the contact person’s details including their name, phone number, fax number, and email address, ensuring all information is accurate.

- In the 'Description of Business / Services Provided' section, detail the nature of your business and the services you offer.

- Select your legal entity type by marking the appropriate checkbox (individual, partnership, corporation, LLC, etc.).

- Indicate the type of building construction by selecting the corresponding option (e.g., wood frame, masonry non-combustible).

- Fill in the square footage occupied by your business and state the number of years your business has been operational as well as your experience in the industry.

- Enter your employer identification number (FEIN) and total estimated annual sales or revenue, along with your total annual payroll for direct employees.

- Indicate whether subcontractors or independent contractors are utilized. If yes, specify if you require a certificate of insurance from them.

- Complete the general liability coverage section, marking the desired per occurrence and aggregate limits.

- If applicable, provide the name and address of any additional insured parties as required by your lease.

- Consider the optional umbrella liability coverage and indicate your desired limit if you wish to include this coverage in your policy.

- Determine if any autos are titled in the name of your business and proceed accordingly for business auto coverage options.

- Input the requested policy effective date.

- Finally, ensure that the applicant signature field is signed by the owner, officer, or partner along with the date.

Complete your General Liability Questionnaire online today for effective coverage!

The standard general liability limit often consists of $1 million per occurrence and $2 million in total annual coverage. These limits provide a baseline for businesses to protect themselves against possible risks. When you are working through a General Liability Questionnaire, it's essential to consider these standard limits to ensure adequate protection tailored to your industry’s specific needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.