Get Uri Substitute W9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uri Substitute W9 online

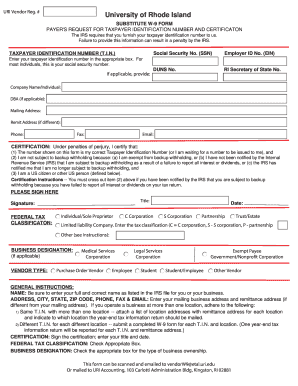

Completing the Uri Substitute W9 form online is essential for providing your taxpayer identification number to the University of Rhode Island. This guide is designed to help you navigate each section of the form efficiently and accurately.

Follow the steps to complete your Uri Substitute W9 form online.

- Press the ‘Get Form’ button to access the Uri Substitute W9 form and open it in the designated editor.

- Enter your taxpayer identification number in the appropriate field. For individuals, this is usually your social security number. If applicable, provide your Employer ID Number (EIN) or DUNS number as necessary.

- Fill in your full name as listed in the IRS records in the 'Company Name/Individual' field. If applicable, include your 'Doing Business As' (DBA) name.

- Fill out your mailing address and, if different, your remit address. Include your phone number, fax number, and email address.

- Review the certification section. Ensure that you understand the statements listed, then indicate your agreement by signing in the designated box. Don’t forget to enter your title and the date.

- Check the box that corresponds to your federal tax classification, such as Individual/Sole Proprietor, C Corporation, or other applicable categories.

- If applicable, check the business designation box that describes your vendor type, such as 'Medical Services Corporation' or 'Employee.'

- After filling out all the necessary fields, save your changes. You can also choose to download, print, or share the completed form.

Complete your Uri Substitute W9 form online today for seamless processing.

The substitute form for a 1099 is the accompanying documentation that supports the information provided on the 1099 form itself. One effective approach is to use the Uri Substitute W9 to gather necessary details from contractors before issuing a 1099. This step ensures you collect accurate data for reporting payments and avoiding potential penalties. By utilizing the Uri Substitute W9, you can streamline the tax reporting process alongside your 1099 forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.