Loading

Get Riversource 1035 Exchange Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Riversource 1035 Exchange Form online

The Riversource 1035 Exchange Form is a crucial document for individuals looking to transfer their insurance or annuity contracts to a different provider. This guide will help you navigate the process of completing this form online, ensuring a smooth and efficient exchange.

Follow the steps to fill out the Riversource 1035 Exchange Form online successfully.

- Click ‘Get Form’ button to access the Riversource 1035 Exchange Form and open it in your preferred online editor.

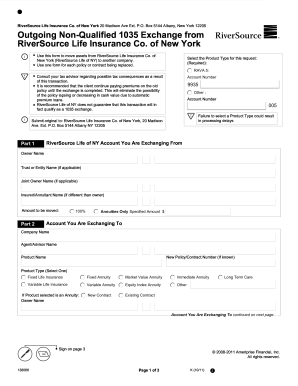

- In Part 1, provide information regarding the RiverSource Life of NY account you are exchanging from, including the owner’s name, trust or entity name if applicable, and the insured or annuitant's name if it differs from the owner.

- Indicate the amount to be moved from the current account by selecting either 100% or specifying an amount in the designated field.

- Proceed to Part 2, where you will enter the information for the new account you are exchanging to. Include the company name, agent or advisor name, and product name.

- If known, fill in the new policy or contract number, and select the product type from the provided options. Specify if this is a new or existing contract.

- For annuities, complete the indicated fields such as the owner name and other relevant details for the new contract.

- Continue providing the delivery instructions, including the payable name and mailing address, ensuring all fields are thoroughly filled.

- In Part 3, acknowledge the absolute assignment and signature conditions by reading them carefully, then complete all necessary signature fields for yourself and any joint owners or spouses if applicable.

- Finally, review the entire form for any missing information or errors and click to save changes. You can also download, print, or share the completed form as needed.

Complete your Riversource 1035 Exchange Form online today for a seamless transfer.

To complete a 1035 exchange, first, obtain the Riversource 1035 Exchange Form from a reliable source. Fill it out with precise details of your current and new policy. Submit the completed form to your new insurer and ensure the old policy provider understands the transfer. This method streamlines your exchange and helps protect your investment against unnecessary taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.