Get Form 15c 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 15c online

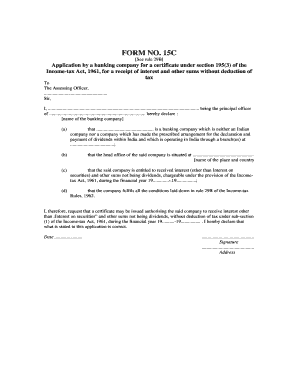

Form 15c is an application by a banking company for a certificate under section 195(3) of the Income-tax Act, 1961. This guide provides a clear and structured approach to completing the Form 15c online, ensuring that you provide all necessary information accurately.

Follow the steps to complete Form 15c effectively.

- Use the ‘Get Form’ button to access and open the Form 15c for online completion.

- Enter the name of the banking company in the space provided. This identifies the entity applying for the certificate.

- In the next section, state whether the company is an Indian company. Specify that it is neither an Indian company nor a company that has made the required arrangements for paying dividends in India.

- Specify the location of the branch(es) in India where the company operates. This information helps the authorities understand the jurisdiction.

- Input the address of the head office of the banking company, including the city and country. Accurate details are crucial for processing your application.

- State the financial year in which the company is entitled to receive interest and other sums. This is vital for establishing the timeframe for the request.

- Confirm that the company meets all conditions laid down in rule 29B of the Income-tax Rules, 1962. This affirmation is an essential part of the application.

- Finally, review all information entered for accuracy before signing the application. Add your signature, date, and address to complete the form.

- Once you have completed the form, you can save the changes, download, print, or share the form as needed.

Start filling out your Form 15c online today for efficient document management.

You can download the 15CA utility from the official Income Tax Department’s website by visiting the relevant section dedicated to utilities and tools for e-filing. This utility is designed to simplify the completion of Form 15CA and ensure compliance with tax obligations. Following the installation instructions carefully ensures proper functionality. If you encounter any difficulties, USLegalForms can provide guidance on resources available for your downloading needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.