Loading

Get Spcc1 Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Spcc1 Online online

The Spcc1 Online form is an essential document for claiming the Single Person Child Carer Credit. This guide provides clear instructions on how to accurately complete the form online, ensuring a smooth submission process.

Follow the steps to fill out the Spcc1 Online form successfully.

- Press the ‘Get Form’ button to access the Spcc1 Online form and open it in the online editor.

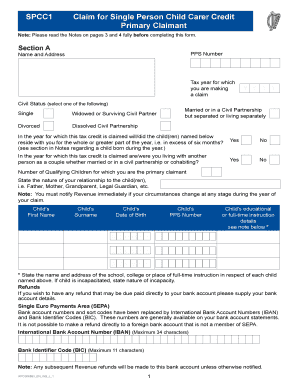

- In Section A, enter your Personal Public Service (PPS) Number, your name, and your address. Select the tax year for which you are making the claim from the dropdown menu. Next, choose your civil status from the available options.

- Indicate whether the child or children reside with you for more than six months of the claim year by selecting 'Yes' or 'No'.

- Answer whether you were living with another person as a couple during the year in question, selecting 'Yes' or 'No'.

- Provide the number of qualifying children for whom you are the primary claimant. For each child, specify your relationship to them (e.g., Father, Mother) and fill in their details including their first name, surname, date of birth, and PPS number.

- If the child is receiving full-time instruction, include the name and address of their educational establishment in the dedicated section.

- In the refund section, if you wish to receive any refunds directly into your bank account, enter your International Bank Account Number (IBAN) and Bank Identifier Code (BIC). Remember, these are essential for processing any potential refunds.

- If you are relinquishing your claim, complete Section B with the necessary details of the new claimant, including their name, address, PPS number, and date of birth.

- Proceed to Section C, read the notes carefully, and insert a 'T' to confirm you have understood the Notes. Sign the declaration confirming all details provided are accurate.

- Once completed, save your changes, and download the form if necessary. You can also print or share the form as needed.

Complete the Spcc1 Online form and submit it today to ensure you receive the tax credit you are entitled to.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The minimum tax return for a child typically depends on various factors including their income and the source of that income. Generally, if a child's earned income is above a certain threshold, they may need to file a return. Using Spcc1 Online can help you determine if your child must file, simplifying the process significantly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.