Get Application For Approved Exporter Status - Hm Revenue & Customs - Hmrc Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Approved Exporter Status - HM Revenue & Customs online

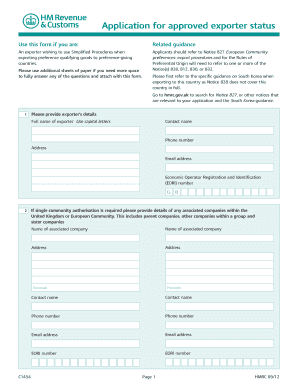

Completing the Application For Approved Exporter Status is an essential step for exporters wishing to utilize Simplified Procedures when exporting goods to preference-giving countries. This guide provides clear instructions to help you navigate and fill out the online form effectively.

Follow the steps to successfully complete your application.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the exporter’s details in section 1, including the full name of the exporter, contact name, phone number, address, email address, and Economic Operator Registration and Identification (EORI) number.

- If a single community authorization is required, provide details of any associated companies within the UK or European Community. Include names, addresses, contact names, phone numbers, and EORI numbers for these companies.

- In section 3, describe the goods to be exported and enter the full 10-digit commodity code. For assistance with the commodity code, refer to the HMRC Tariff Classification Service.

- Provide an estimate of the quantities and value of consignments to be exported each year. Include realistic estimates based on current contracts and future expansion plans.

- Indicate whether you are the manufacturer of the goods. If you are not, provide the supplier's details in the next sections, including their name and an estimate of the value of consignments.

- If applicable, indicate whether you hold evidence of origin for any components you buy or import. Attach the required proofs of origin with your application.

- Describe how the goods meet the conditions of preferential origin. Reference the appropriate Notices for guidance on rules of origin and provide evidence such as costings or details of the manufacturing process.

- State all the countries you plan to export to using the approved exporter scheme, and indicate if you may export to other preference countries in the future.

- Indicate your preferences for invoice declarations or pre-authenticated A.TR certificates for Turkey as indicated in the application.

- Complete the declaration section, providing the name and details of the signatory. Ensure the application is signed and dated.

- Send the completed application form along with any supporting documents to the specified HM Revenue & Customs address. Make sure to also send it to your HM Revenue & Customs Client Relationship Manager if applicable.

Complete your documents online today to streamline your export process!

Holding approved exporter status provides significant advantages, such as improved market access and enhanced reputation within the industry. Status holders often experience expedited customs processing, which can lead to lower operational costs. Applying for and maintaining the Application For Approved Exporter Status - HM Revenue & Customs - Hmrc Gov can thus be a strategic decision for businesses aiming to strengthen their competitive edge.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.