Loading

Get Tax Transcript 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Transcript online

Filling out a Tax Transcript online can be a straightforward process when you know what to look for. This guide provides a step-by-step approach to help users understand each section and field of the form with ease.

Follow the steps to successfully complete your Tax Transcript online.

- Press the ‘Get Form’ button to access the Tax Transcript form and open it in your preferred editor.

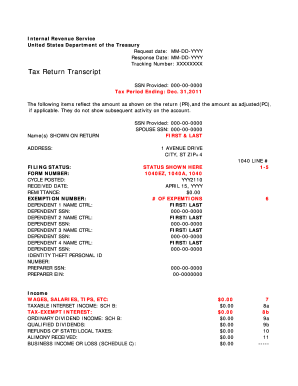

- Review the Tax Transcript header which includes the request date and response date. Confirm that these dates are correct and complete.

- In the 'Tax Return Transcript' section, ensure the Social Security Number (SSN) is accurately provided. This should reflect the primary taxpayer's SSN.

- Complete the 'Tax Period Ending' date to indicate the applicable tax year covered by the transcript.

- Fill in the section that includes the names shown on the return. Ensure the names are as listed on the tax return.

- Input the address details under the 'ADDRESS' section. This should match the address on your tax return.

- Select the appropriate 'Filing Status' from the dropdown options, which typically includes choices like single, married filing jointly, etc.

- Confirm the 'Form Number' that corresponds to the tax return submitted, such as 1040, 1040A, or 1040EZ.

- Enter the 'Cycle Posted' date, which may be automatically generated or need to be filled based on your records.

- Review the 'Income' section and fill in the various income fields as applicable. These may include wages, interest, dividends, and other income sources.

- Complete the 'Adjustments to Income' section if applicable, detailing any adjustments such as educator expenses or IRA deductions.

- Fill in the 'Tax and Credits' section, noting any credits or additional taxes for accuracy.

- Ensure that any 'Payments' made are documented correctly in the appropriate fields.

- Review the 'Refund or Amount Owed' section to confirm any refund amounts or taxes owed are accurate.

- Check the 'Third Party Designee' area for any third parties authorized to discuss your tax information.

- Finally, double-check all entries for accuracy. Once confirmed, you can save your changes, download, print, or share the completed form as needed.

Get started now by filling out your Tax Transcript online!

No, a tax transcript is different from a certificate. A tax transcript gives details about your tax filing history, while a certificate, like a tax exemption certificate, verifies specific tax-related statuses. It's important to request the right document based on your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.