Loading

Get Profit And Loss Statement Centrelink 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Profit And Loss Statement Centrelink online

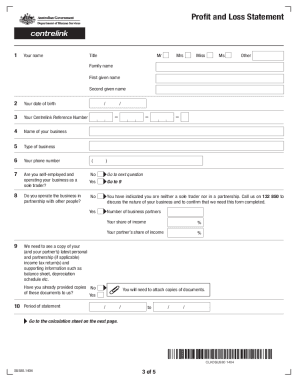

Filling out the Profit And Loss Statement Centrelink is essential for sole traders and partners who need to report their income and expenses accurately. This guide provides clear, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to complete your Profit And Loss Statement effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter your personal details in the provided sections, including your name, date of birth, Centrelink Reference Number, and contact information.

- Indicate whether you are self-employed as a sole trader or in a partnership by selecting the appropriate option.

- Provide the name and type of your business in the respective fields.

- Detail your gross business income for the statement period in the specified section.

- List your non-variable expenses in the expense section. Be sure to include accountancy fees, depreciation, insurance premiums, and other relevant costs.

- Record your variable expenses, reflecting the statement period. Include costs such as advertising, motor vehicle running costs, and wages.

- Calculate the total of all expenses and the net income by following the instructions provided on the form.

- Sign and date the form, declaring that the information provided is complete and correct.

- Return the completed form and any additional documents to the appropriate service center or submit them online within the specified timeframe.

Complete your Profit And Loss Statement Centrelink online today to ensure accurate reporting and entitlement assessment.

Related links form

To arrange a profit and loss account, begin by listing all income sources, then note the direct costs associated with generating that income. After calculating your gross profit, subtract operating expenses to reach your net profit or loss. Proper organization is vital for clarity, especially when preparing your Profit And Loss Statement Centrelink.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.