Loading

Get Form 15h

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 15h online

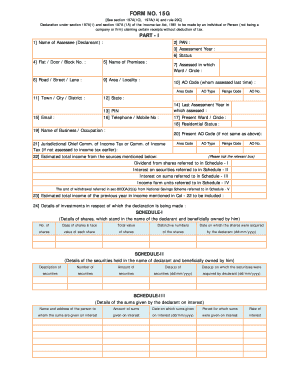

Filling out Form 15h online is essential for individuals who want to declare their income without the deduction of tax. This guide provides a comprehensive overview of each section of the form, ensuring a smooth and accurate submission process.

Follow the steps to complete Form 15h online.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Begin by entering your name in the 'Name of Assessee (Declarant)' field. Ensure this matches your official documents.

- Input your Permanent Account Number (PAN) in the designated field. This is crucial for tax identification.

- Select the appropriate assessment year for which the declaration is being made.

- Fill in your flat or door number, followed by the name of your premises in the respective fields.

- Record your complete address, including road, street, lane, area, locality, town, city, district, and state.

- Provide your email address and telephone or mobile number to facilitate communication.

- Indicate the ward or circle where you were last assessed, and include the AO code.

- Enter the last assessment year in which you were assessed to provide context for your current declaration.

- Describe your current residential status as well as your business or occupation.

- Fill out the estimated total income section by selecting the sources from the listed options.

- In the details of investments section, provide information related to shares, securities, and sums given on interest.

- Complete the declaration verification section, confirming that the information provided is accurate and complete.

- After filling out all sections, review your information for accuracy.

- Once completed, save changes, and you may choose to download, print, or share the completed form.

Start filling out your Form 15h online today to ensure accurate tax declaration.

Related links form

The form for investment declaration varies based on the type of investment and its specific requirements. Commonly used forms include Form 15g and Form 15h for tax-related declarations on income. Each form serves to ensure compliance with tax regulations and protects your financial interests. Choosing the correct form is crucial to avoid complications down the line.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.