Loading

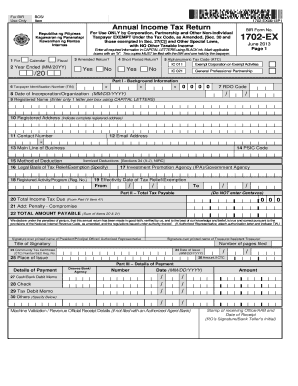

Get Ebir Form Offline 1702 Ex 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ebir Form Offline 1702 Ex online

This guide provides clear instructions on how to effectively complete the Ebir Form Offline 1702 Ex for non-individual taxpayers exempt under the tax code. By following these steps, you can ensure your form is filled out accurately and completely.

Follow the steps to fill out the Ebir Form Offline 1702 Ex offline.

- Press the ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Determine the type of filing: Indicate whether you are filing for a calendar year or a fiscal year at the top of the form.

- Fill in the taxpayer identification number (TIN) and RDO code accurately, using the format provided on the form.

- Complete the date of incorporation or organization in the format MM/DD/YYYY. Make sure to enter it correctly.

- Enter the registered name of the corporation or partnership, ensuring only one letter is placed in each box using capital letters.

- Provide the complete registered address, contact number, email address, and main line of business for accurate identification.

- Specify the applicable alphanumeric tax code (ATC) based on your business type, choosing from the options listed in the form.

- Indicate the legal basis for any tax relief or exemptions you are claiming, along with any relevant registration numbers for activities or programs.

- Complete sections on total income tax due, penalties, and total amount payable. Make sure to calculate these amounts accurately.

- Sign the form where indicated, including printed names and titles of the signatories to authenticate the document.

- Count the number of pages being filed and complete the community tax certificate number, place of issue, and date of issue if applicable.

- Review the entire form for completeness and accuracy before saving changes. Ensure no centavos are entered where not required.

- Once completed, you can download, print, or share the form as needed for filing with the Bureau of Internal Revenue.

Complete your Ebir Form Offline 1702 Ex online to streamline the filing process and ensure compliance.

Downloading eBIRForms version 7.9 4 is straightforward. You can visit the BIR's official website or trusted platforms like US Legal Forms. Follow the instructions provided, select the appropriate version, and click the download button to install the software on your device. This ensures you have the latest tools for filing your taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.