Loading

Get Vat201 Form In Excel Format

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat201 Form In Excel Format online

Filling out the Vat201 Form in Excel format online can streamline the process and ensure accurate reporting. This guide provides clear, step-by-step instructions on completing each section of the form, making it accessible even for those with minimal legal experience.

Follow the steps to successfully complete the Vat201 Form online.

- Click ‘Get Form’ button to obtain the Vat201 Form and open it in the editing software.

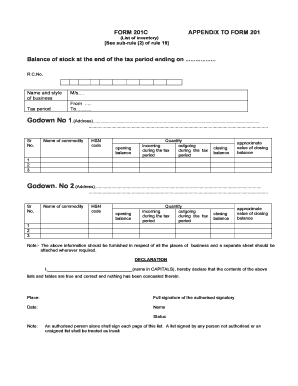

- Enter the balance of stock at the end of the tax period by indicating the specific date in the designated field.

- Input the registration certificate number (R.C.No.) in the appropriate section to ensure proper identification of your business.

- Fill in the name and style of your business, including the tax period, to provide necessary context for the reporting.

- For each godown, enter the address clearly in the provided space, ensuring correct reporting of inventory locations.

- List the commodities in the inventory, including their HSN codes in the specified columns, noting the opening balance accurately.

- Record incoming and outgoing quantities for the tax period, ensuring that all transactions are accounted for appropriately.

- Calculate and enter the closing balance of each commodity to reflect the accurate stock at the end of the reporting period.

- Estimate and provide the approximate value of the closing balance for each commodity, as this assists in financial assessments.

- Complete the authorization section by entering your name in capital letters, signing, and ensuring it is dated.

- Ensure that the list is signed by an authorized person. An unsigned or improperly signed list will be considered invalid.

- Once all information is inputted, save your changes, download the document, or print to finalize your submission.

Start filling out your Vat201 Form online today for accurate reporting and efficient management.

To put a VAT formula in Excel, start with your net amount and multiply it by the VAT rate. For example, if your VAT rate is 20%, you can input the formula '=Net_Amount20%' into a cell. This calculation is particularly useful when managing complex datasets in a VAT201 Form In Excel Format, aiding in precise VAT management.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.