Get Ca5601

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ca5601 online

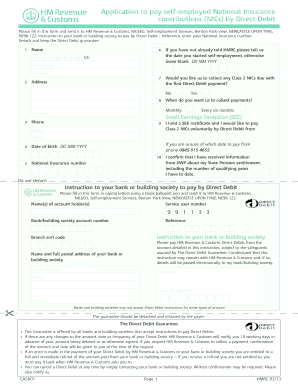

The Ca5601 form is essential for self-employed individuals who wish to pay their National Insurance contributions via Direct Debit. This guide provides step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to complete the Ca5601 online.

- Press the ‘Get Form’ button to access the Ca5601. You will be directed to the editor where the form will be available for completion.

- Begin by entering your name in the designated fields, specifying your title (Mr, Mrs, Miss, Ms, or other), first name(s), and surname.

- Provide your current address, including your postal code, ensuring accuracy for correspondence.

- Fill in your date of birth using the format DD MM YYYY.

- Enter your National Insurance number precisely, as it is crucial for your contribution records.

- Indicate the date you commenced self-employment. If you have not informed HMRC of this date already, please fill in the details; otherwise, leave this section blank.

- Select the frequency for collecting payments: choose 'Monthly' or 'Every six months,' or indicate if you hold a Small Earnings Exception certificate and wish to pay voluntarily.

- Provide your contact information by entering your phone number, including both home and mobile numbers if applicable.

- Confirm that you have received information from the Department for Work and Pensions about your State Pension entitlement and the number of qualifying years you have to date.

- Complete the bank/building society details, including account holder names, service user number, account number, reference, and branch sort code, ensuring all details are correct.

- Sign and date the form to authorize the Direct Debit instruction and retain the Direct Debit guarantee section for your records.

- After reviewing all entries for accuracy, save your changes, download or print the completed form, as necessary, before sending it to HM Revenue & Customs at the specified address.

Complete your Ca5601 form online to ensure your self-employed National Insurance contributions are managed seamlessly.

Yes, it is possible to claim both Irish and UK state pensions if you have met the necessary contribution requirements in both countries. The agreements between the UK and Ireland facilitate this process, helping individuals access benefits from both systems. Filling out the Ca5601 form can help clarify your eligibility regarding contributions made in either country. Therefore, don’t hesitate to explore both options for your retirement income.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.