Get Supplement To Form W 8ben Citibank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Supplement To Form W 8ben Citibank online

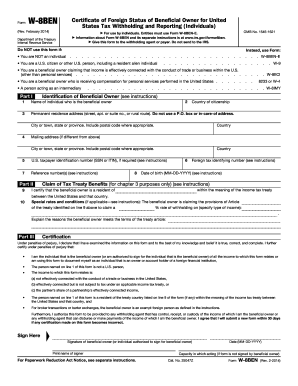

Completing the Supplement To Form W 8ben Citibank is essential for foreign individuals or entities claiming benefits under U.S. tax treaty provisions. This guide provides a straightforward and supportive approach to assist you in accurately filling out the form online.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Part I requires you to enter the name of the beneficial owner in the specified field. Ensure that you provide the exact name as it appears on legal documents.

- Next, in the second field, indicate the country of incorporation or organization. This should be the country where the beneficial owner is legally based.

- Select the type of beneficial owner by checking the appropriate box. Options include corporation, partnership, individual, and others listed.

- Fill out the permanent residence address section, avoiding any P.O. boxes or in-care-of addresses. Provide the complete street address, city, state, and postal code.

- If the mailing address differs from the permanent address, complete the mailing address section with the same level of detail.

- Enter the U.S. taxpayer identification number in line 6 if required; otherwise, skip this field. If applicable, also provide the foreign tax identifying number.

- In Part II, check all applicable boxes to certify your eligibility for withholding benefits under the U.S. tax treaty. Ensure each box accurately reflects your situation.

- If claiming special rates, specify the type of income and the applicable withholding rate, referencing the relevant article from the tax treaty.

- In Part IV, sign and date the form, confirming that the information is complete and accurate to the best of your knowledge.

- Finally, review the filled form for any errors and ensure all necessary fields are completed before saving changes, downloading, printing, or sharing the form as required.

Start filling out your documents online now for a clear and efficient experience.

To fill out a W-8BEN form, start by providing your name, country of citizenship, and permanent address. Then, include your U.S. taxpayer identification number, if applicable, and sign the form affirming that you qualify as a non-U.S. individual. Using platforms like USLegalForms can simplify the process of preparing the Supplement To Form W 8ben Citibank, making it straightforward to comply with legal requirements.

Fill Supplement To Form W 8ben Citibank

To support my claim of foreign status, please see indicated reason(s) below. Clients may use the Supplement to Form W-8BEN. Give Form W8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. Looking for Supplement To Form W 8ben Citibank to fill? Purpose of Form: Establishing status for chapter 3 purposes. A reduced rate may apply if you have provided a Form W-8BEN1 with a valid treaty claim with a country that provides for a lower withholding rate. Provisions with respect to the exchange of debt securities in bearer form will be described in the applicable supplement. Owner for United States Tax Withholding and Reporting (Entities) on file with Citibank. We've provided important tax reporting forms for your deposit accounts here, making it a little easier to complete your returns. Non-resident aliens need to complete this form if additional documentation is required to validate Form W-8BEN.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.