Loading

Get Brass Payroll Deduction Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Brass Payroll Deduction Form online

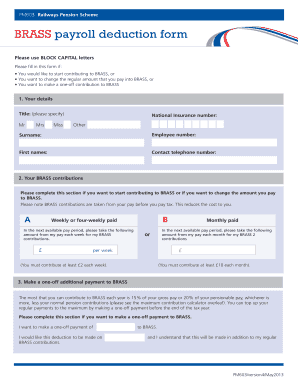

The Brass Payroll Deduction Form is essential for users who wish to begin or modify their contributions to the BRASS pension scheme. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully fill out the form online.

- Press the ‘Get Form’ button to access the Brass Payroll Deduction Form. This will allow you to open the form and begin filling it out electronically.

- In the first section, provide your personal details. Fill in your title (Mr, Mrs, Miss, or Other), National Insurance number, surname, employee number, first names, and contact telephone number using BLOCK CAPITAL letters.

- In the second section, indicate the amount you wish to contribute to BRASS regularly. Choose whether you are paid weekly or monthly, and specify the amount you want deducted from your pay. Ensure that your contributions meet the minimum requirements of £2 per week or £10 per month.

- If you wish to make a one-off additional payment, complete the third section. Specify the amount you intend to contribute once and indicate if this deduction is in addition to your regular payments.

- Next, in the fourth section, if you are starting contributions, remember that you must complete a PM84 ‘BRASS future contributions fund choices’ form to select your preferred funds. If you change your contributions, your existing fund choices will continue unless you make a new selection.

- In the declaration section, confirm that you want the specified amounts to be deducted from your pay before tax. Sign and date the form.

- Finally, ensure that you submit the completed form to your payroll department for processing. You may also calculate your maximum contribution using the provided calculator section, if needed.

Start completing your Brass Payroll Deduction Form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

On a railway, brass contributions often play a significant role in employees’ pension systems, providing them with additional retirement funding. These contributions typically allow employees to direct a portion of their salary into a designated fund. To start or adjust your contributions, you will need to submit a Brass Payroll Deduction Form, ensuring your financial future is secure while working in the railway sector.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.