Loading

Get Form 8882

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8882 online

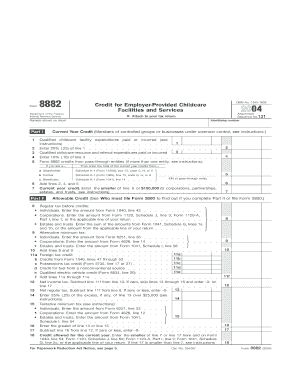

Filling out Form 8882 online can simplify the process of claiming the credit for qualified childcare facilities and expenditures. This guide will provide you with clear step-by-step instructions to ensure a smooth experience as you complete the form.

Follow the steps to fill out the Form 8882 online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I, which focuses on calculating the current year credit. Enter your qualified childcare facility expenditures on line 1 as defined in the instructions.

- On line 3, enter your qualified childcare resource and referral expenditures incurred during the tax year, as specified in the form.

- Line 5 requires you to enter any credit amounts allocated to you from pass-through entities. Include the employer identification number (EIN) of the entity. If you received credits from multiple entities, write 'see attached' and include a statement with details.

- Continue to line 6 where you will enter the total of the current year credits calculated from lines 2, 4, and 5.

- In Part II, if applicable, calculate the allowable credit based on your tax liability. Fill in lines 8 through 10 as required, taking into account your regular tax before credits.

- Complete the necessary lines for alternative minimum tax, if applicable, and ensure all calculations are accurate.

- Once you have filled out all sections, review the form for correctness. Save your changes, and download or print your completed Form 8882 for submission with your tax return.

Get started with filling out your Form 8882 online today!

Receiving a 1099-C, which reports cancelled debts, can have implications for your credit score, depending on your overall credit profile. While it signifies that a debt was forgiven, it may also indicate previous repayment issues. Always consider consulting a financial adviser to understand the broader impacts of Forms like 8882 when dealing with credit-related concerns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.