Loading

Get Ia 81 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ia 81 online

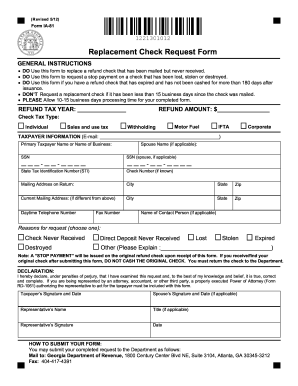

Filling out the Ia 81 replacement check request form can seem daunting, but with this step-by-step guide, you can complete it with ease. This guide aims to provide you with clear instructions to ensure you accurately fill out the form online.

Follow the steps to successfully complete your Ia 81 form.

- Press the ‘Get Form’ button to access the Ia 81 replacement check request form and open it in your preferred online editor.

- Enter the refund amount in the designated field. Ensure that you provide the exact amount you are requesting.

- Specify the tax year for the refund by entering the corresponding year in the appropriate section.

- Select the type of tax for which you are requesting a refund by checking the relevant box.

- Input your taxpayer information, including your email address, name or name of the business, and social security number.

- If applicable, include your spouse's name and social security number in the designated fields.

- Provide your state tax identification number and check number, if known.

- Fill in your mailing address as it appears on your return. Include city, state, and zip code.

- If your current mailing address differs from the previous one, fill in the current address, city, state, and zip code.

- Enter your daytime telephone number and fax number, if applicable.

- List the name of a contact person if you are having someone else handle this request on your behalf.

- Choose the reason for your request by selecting one of the options provided. If you select 'Other,' please provide an explanation in the space provided.

- Review the declaration statement, then sign and date the form in the taxpayer's section and the spouse’s section, if applicable.

- If you are being represented by someone else, ensure they complete their information, including name, title, signature, and date.

- Once you have completed all sections of the form, you can save your changes, download the form, print it, or share it as needed.

Complete your Ia 81 form online and submit it for processing today.

Related links form

Generally, you do not need to submit your federal return with your Georgia state return, unless specifically requested by the state. However, keeping a copy for your records is wise. For assistance navigating these requirements, you can turn to UsLegalForms, a platform designed to clarify and streamline tax filing processes under Ia 81, helping you stay compliant and organized.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.