Loading

Get Ufs 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ufs 1 online

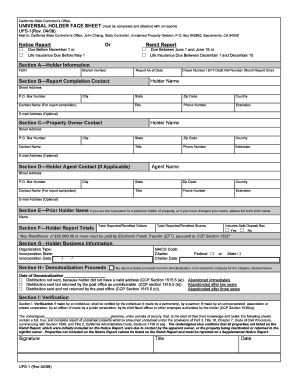

Filling out the Ufs 1 form online is essential for effectively reporting unclaimed property. This guide will provide you with clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to effectively complete the Ufs 1 form online.

- Click the ‘Get Form’ button to access the Ufs 1 form. This will allow you to open it in the editor for completion.

- In Section A, enter the holder information including the Federal Employer Identification Number (FEIN), branch number, and the report as of date. If submitting a remit report, include the check number or EFT debit reference number.

- For Section B, provide the report completion contact details. Include the street address or P.O. Box number, city, state, and zip code. Additionally, record the contact name and phone number, along with the title and extension.

- Section C requires the property owner contact information. Fill in the street address or P.O. Box number, city, and the contact person's name. An optional email address can also be included.

- If applicable, complete Section D with the holder agent contact information. Include the street address or P.O. Box number, city, and the contact name. You can also include an optional email address.

- For Section E, if you are the successor to a previous holder or if your name has changed, list the prior name here.

- In Section F, report your totals by entering the total reported or remitted dollars and shares. Indicate whether your report includes safe deposit boxes by selecting 'Yes' or 'No'. Remember, any remittance of $20,000 or more must be done via Electronic Funds Transfer.

- Complete Section G by providing the holder business information, including the organization type, incorporation state, and incorporation date.

- In Section H, if applicable, include information regarding demutualization proceeds. Fill in the NAICS code, charter details, and select the applicable category regarding distribution.

- Finally, in Section I, verify the report. The undersigned must declare, under penalty of perjury, the truthfulness of the report. Include the signature, title, and date of completion.

- Once you have filled out all necessary sections, save any changes made to the form. You may download, print, or share the completed form as needed.

Start completing your documents online to ensure timely reporting.

The dormancy period in California is typically defined as the period during which a property owner has not taken any action regarding their assets. For most types of unclaimed property, this period lasts three years. It’s advisable to stay informed about your accounts to prevent them from entering dormancy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.