Loading

Get Drs Pw

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Drs Pw online

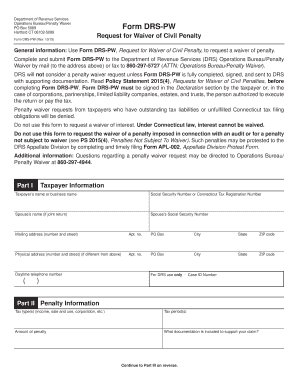

This guide provides a step-by-step approach to completing Form DRS-PW, the Request for Waiver of Civil Penalty, online. The form is essential for users seeking to request a penalty waiver from the Department of Revenue Services in Connecticut.

Follow the steps to successfully complete the Drs Pw form online.

- Click the ‘Get Form’ button to access the document and open it for editing.

- In Part I, provide the taxpayer information, including the taxpayer’s name or business name, Social Security Number or Connecticut Tax Registration Number, and spouse’s information if applicable.

- Enter the mailing and physical addresses, ensuring all address fields are filled out accurately, including apartment number, city, state, and ZIP code.

- Fill in the daytime telephone number to ensure DRS can reach you if needed.

- Proceed to Part II to specify the penalty information, including the tax type(s), tax period(s), and the amount of the penalty.

- Detail the documentation that supports your claim within Part II.

- Continue to Part III, where you will provide comprehensive information regarding the reasons for noncompliance with tax obligations. Respond to each inquiry, supplying specific facts and circumstances.

- Add any additional sheets necessary to provide thorough answers and attach any supporting documentation, such as medical records or police reports, as indicated in the guide.

- In the Declaration section, ensure all declarations are completed accurately and sign the form, including printing your name and the date.

- Once all sections are filled out correctly, save your changes. You can then download, print, or share the completed form as needed.

Complete your documents online to streamline your requests and meet your needs efficiently.

Penalty Abatement Overview on Connecticut Back Taxes. When you pay state taxes late, the state immediately imposes a penalty of 10% of the balance on your account, and your tax bill may incur other penalties as well. In some cases, you may qualify for a penalty waiver, but you have to apply.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.