Loading

Get G4 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G4 Form online

Filling out the G4 Form online can streamline the process of managing your withholding allowances. This guide provides a clear and supportive approach to completing the form, ensuring that you can accurately submit your information to your employer.

Follow the steps to complete the G4 Form effectively.

- Click ‘Get Form’ button to acquire the G4 Form and open it in your preferred digital platform.

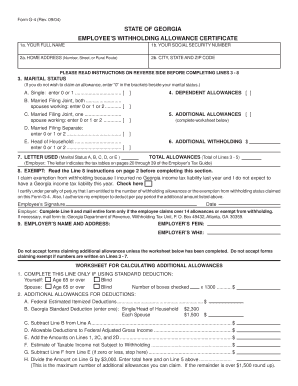

- Enter your full name in the first box, followed by your home address in the designated section. Additionally, provide your social security number in the specified field.

- Indicate your marital status by entering the number of allowances you wish to claim in the corresponding brackets. Choose from single, married filing jointly (both spouses working), married filing jointly (one spouse working), married filing separately, or head of household.

- In the section for dependent allowances, specify the number of allowances you are entitled to claim for dependents. Enter the amount into the given field.

- Complete the worksheet provided at the bottom of the form if you are claiming additional allowances. The total number of additional allowances should be entered into the designated field.

- If you wish to authorize an additional amount to be withheld per pay period, enter that specific dollar amount in the subsequent line.

- Record the letter corresponding to your marital status as selected in Line 3. Calculate and enter the total number of allowances from Lines 3 through 5.

- If applicable, check the box indicating your claim for exempt from withholding. Ensure you meet the requirements outlined in the instructions before checking this box.

- Finally, sign and date the form where indicated, confirming the accuracy of the information provided.

- Once completed, save your changes, and proceed to download, print, or share the form with your employer.

Complete your G4 Form online today to manage your withholding allowances effectively.

Related links form

If you are an employee in Georgia and wish to properly manage your state tax withholding, you need to fill out a G4 Form. This form helps you determine how much tax is deducted from your paychecks. Visit the US Legal Forms platform for comprehensive resources to simplify this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.