Loading

Get Form 3521 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3521 online

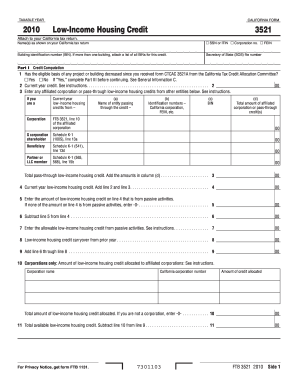

Filling out the Form 3521 for the Low-Income Housing Credit is a crucial step for those engaged in residential rental projects in California. This guide provides a clear and friendly comprehensive approach to assist you through each section and field of the form, ensuring you meet your tax obligations accurately and efficiently.

Follow the steps to complete your Form 3521 online

- Press the ‘Get Form’ button to access the form and open it in an editor for online use.

- Begin by entering your name(s) as shown on your California tax return. Ensure that your information is accurate and complete.

- Select the appropriate identification option: Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), Corporation number, or Federal Employer Identification Number (FEIN). Fill in the chosen identification number.

- Input the Building Identification Number (BIN). If you have multiple buildings, attach a detailed list of all BINs related to this credit.

- Fill in the Secretary of State (SOS) file number if applicable.

- Proceed to Part I - Credit Computation. Answer question 1 regarding the eligible basis of any project or building and complete Part III if necessary.

- Enter the current year credit in line 2. Follow the provided instructions to calculate this accurately.

- If applicable, enter any affiliated corporation or pass-through low-income housing credits from other entities in line 3.

- Sum the credits in line 2 and any credits from line 3 to complete line 4.

- Continue completing any additional calculations in Part I as required through lines 5 to 11.

- If you completed Part II - Carryover Computation, fill in lines 12a and 12b, and calculate the carryover for future years in line 13.

- If a basis recomputation is necessary, utilize Part III to enter the required details about each building.

- Review all entered information for accuracy and completeness. Make any necessary adjustments.

- Once completed, you can save your changes, download, print, or share the completed form as needed.

Get started on your Form 3521 today and ensure your filing is accurate and timely.

Form 3520 does not automatically get an extension, unlike other tax forms. You must apply for an extension if you need more time. US Legal Forms can help you navigate this process and manage your deadlines efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.