Loading

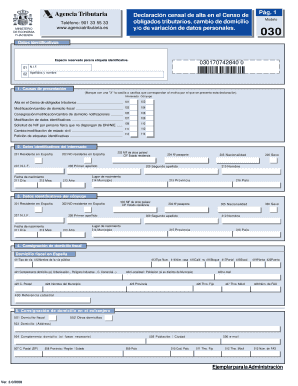

Get Modelo 030 Pdf 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Modelo 030 Pdf online

The Modelo 030 is an essential document used for various tax-related applications in Spain. This guide provides a clear, step-by-step approach to help users complete the form online efficiently and accurately.

Follow the steps to complete the Modelo 030 Pdf online.

- Click the ‘Get Form’ button to acquire the Modelo 030 Pdf and open it in your editing tool.

- Indicate the reasons for submission by marking the relevant boxes for the type of application you are submitting. Options may include registration in the tax registry or changes in personal information.

- Fill in the user identification details. This includes specifying whether the user is a resident in Spain, providing their NIF, and entering their personal information such as their name, surname, date of birth, and nationality.

- If applicable, complete the section for the spouse's identification information. Ensure to include the spouse's residency status and necessary personal details.

- In the fiscal address section, provide detailed information about your financial residence in Spain, including the type of street, street name, house number, and postal code.

- If you have a foreign address, fill in the corresponding details under the 'Domicilio en el extranjero' section, including the country, postal code, and other relevant address information.

- Specify the address for notifications, indicating if it differs from the fiscal address. Provide full address details as needed.

- If represented, fill out the representative's identification section with their NIF and reason for representation.

- Select your current marital status and fill in the date related to this status if you are indicating a change.

- Finally, review the declaration section for accuracy and sign the document, ensuring to attach your spouse's signature if required for modifications.

- After completing the form, save any changes made and choose from the options to download, print, or share the completed Modelo 030 Pdf.

Complete your tax documents online with ease today!

A fiscal address in Spain refers to the official address where an individual or company is registered for tax purposes. This address is important as it determines the tax office that handles your tax affairs. By filing the Modelo 030 Pdf, you can set or change your fiscal address to ensure that you comply with local tax regulations effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.