Loading

Get Roundpoint Mortgage Payoff Request

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Roundpoint Mortgage Payoff Request online

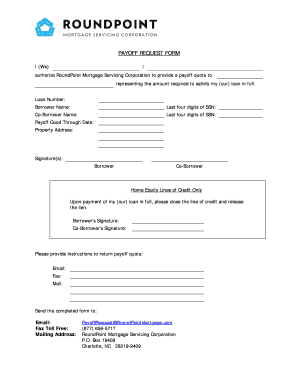

Completing the Roundpoint Mortgage Payoff Request form is an essential step for obtaining a payoff quote from RoundPoint Mortgage Servicing Corporation. This guide will provide you with clear and concise instructions to help you navigate the form efficiently.

Follow the steps to complete your payoff request form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section of the form, enter your authorization. Indicate 'I (We)' to specify who is requesting the payoff quote. This ensures RoundPoint Mortgage Servicing Corporation knows who they are providing the information to.

- Fill in the ‘Loan Number’ field. This is crucial as it identifies your specific mortgage loan account.

- Input the ‘Borrower Name’ field carefully. Use the full legal name of the primary borrower.

- Provide the ‘Last four digits of SSN’ for the borrower. This is a necessary step for identity verification.

- If applicable, complete the ‘Co-Borrower Name’ section with the legal name of the co-borrower.

- Enter the ‘Last four digits of SSN’ for the co-borrower in the designated field.

- Set the ‘Payoff Good Through Date’. This indicates the expiration date of the provided payoff quote.

- Fill in the ‘Property Address’ where the mortgage is associated. Accurate information is vital for processing.

- Proceed to the ‘Signature(s)’ section. The borrower(s) must sign to authorize the request. If there is a co-borrower, their signature is also required.

- If your mortgage includes a home equity line of credit, complete the additional section regarding closing the line of credit and releasing the lien. Sign as the borrower and co-borrower where indicated.

- Indicate the method for returning the payoff quote by filling in your preferred contact method: email, fax, or mail. Provide the necessary details.

- Lastly, you will need to send the completed form to the designated RoundPoint Mortgage Servicing Corporation options provided within the form — whether by email, fax, or mail. Make sure to double-check the contact information for accuracy.

Complete your Roundpoint Mortgage Payoff Request online today for a seamless mortgage payoff experience.

Typically, it takes about 5 to 7 business days to receive your payoff letter from RoundPoint Mortgage. However, this timeframe may vary based on various factors. Once you submit your Roundpoint Mortgage Payoff Request, you can expect a confirmation of your request. Stay in touch with customer service for any updates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.