Get Kentucky Form 4 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kentucky Form 4 online

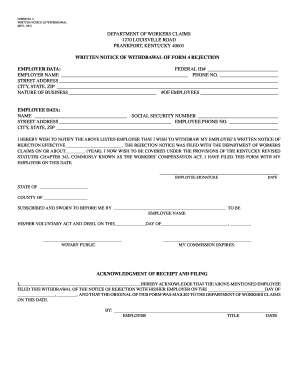

Filling out the Kentucky Form 4 online can streamline your process of withdrawing a notice of rejection for workers' compensation. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Kentucky Form 4 online

- Click ‘Get Form’ button to access the form and open it in your browser.

- Begin by entering the employer data. Fill in the federal ID number, employer name, phone number, street address, city, state, zip code, nature of business, and number of employees.

- Next, provide the employee data. Enter the employee's name, social security number, street address, employee phone number, city, state, and zip code.

- Indicate your desire to withdraw the written notice of rejection by providing the effective date of withdrawal. Also, state the date the rejection notice was originally filed with the Department of Workers Claims.

- Sign the form where indicated to confirm the withdrawal, and include the date of your signature.

- Complete the notary section by providing the state and county, as well as the name of the employee being acknowledged. A notary public must sign and date this section.

- Finally, ensure that the acknowledgment of receipt and filing section is filled out by the employer. They should provide their name, title, and the date of acknowledgment.

- After reviewing the form for accuracy, you can save changes, download, print, or share the completed form as needed.

Complete your Kentucky Form 4 online today for a hassle-free filing experience.

The time it takes to receive a Kentucky tax refund varies but typically ranges from a few weeks to a few months. Factors influencing this timeframe can include the method of filing, accuracy of your return, and current processing times in the state. If you file electronically and correctly, you may receive your refund quicker. The Kentucky Form 4 ensures that your filing meets state requirements to expedite your refund process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.