Loading

Get Va Irrrl Worksheet 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Va Irrrl Worksheet online

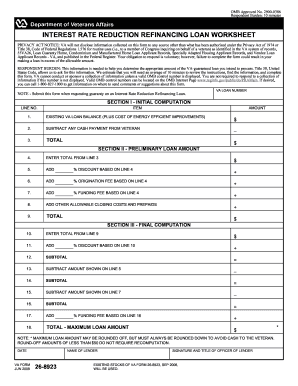

Completing the Va Irrrl Worksheet online is a straightforward process that allows you to effectively manage your interest rate reduction refinancing loan application. This guide provides detailed steps to help you fill out the worksheet accurately and efficiently.

Follow the steps to complete the Va Irrrl Worksheet online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section I - Initial Computation. Input the existing VA loan balance and any associated costs like energy efficient improvements in the designated fields.

- Subtract any cash payment made by the veteran and calculate the total for Line 3.

- Proceed to Section II - Preliminary Loan Amount. Enter the total amount from Line 3 into Line 4.

- Add the applicable discount percentage based on the total amount from Line 4 into Line 5.

- Include the origination fee percentage based on Line 4 into Line 6.

- Add the funding fee percentage calculated from Line 4 into Line 7.

- Incorporate other allowable closing costs and prepaids into Line 8.

- Finally, sum up all amounts to calculate the total in Line 9.

- Move to Section III - Final Computation. Enter the total from Line 9 into Line 10.

- Add the discount amount from Line 10 as indicated into Line 11.

- Calculate the subtotal in Line 12.

- Subtract the amount shown in Line 5 from the subtotal in Line 12.

- Continue with the next subtotal in Line 14.

- Subtract the amount shown in Line 7 from the subtotal in Line 14.

- Calculate the next subtotal in Line 16.

- Add in the discount and funding fee percentages as indicated for the totals in Line 17.

- Finally, calculate the maximum loan amount in the last field, ensuring it rounds down to avoid excess cash to the veteran.

Start filling out the Va Irrrl Worksheet online today for a smoother refinancing process.

While there is no minimum credit score requirement specifically for a VA IRRRL, lenders typically look for a score above 620. Using the VA Irrrl Worksheet can help clarify your financial readiness and expectations. This way, you can better position yourself for approval and potential favorable terms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.