Loading

Get P11d B Form 2019 20 Pdf 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P11d B Form 2019 20 Pdf online

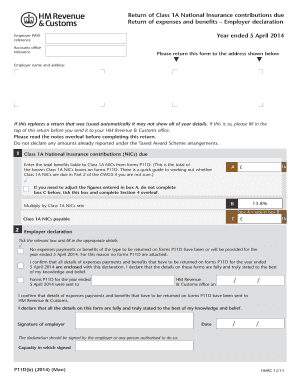

This guide provides clear and supportive instructions for completing the P11d B Form 2019 20 Pdf online. By following these steps, users can ensure accurate filing of this essential document related to Class 1A National Insurance contributions.

Follow the steps to complete your P11d B Form 2019 20 Pdf online.

- Click the ‘Get Form’ button to access the P11d B Form 2019 20 Pdf and open it in your preferred online editor.

- Begin filling out the form by entering your employer PAYE reference and accounts office reference in the designated fields at the top of the form.

- In section 1, report the total Class 1A National Insurance contributions due by inputting the relevant figures from forms P11D into box A. Ensure you add the total of amounts marked as Class 1A from the brown boxes on the P11D forms.

- Multiply the amount in box A by the Class 1A NICs rate (13.8%) and enter this value in box C to indicate the Class 1A NICs payable.

- Move to the employer declaration section and indicate if you have provided any expenses payments or benefits for the reporting year. Tick the appropriate box and fill in necessary details.

- Ensure that you sign and date the form, confirming that all details provided are accurate to the best of your knowledge.

- Review all entries to verify their accuracy. Once complete, save your changes, and you can choose to download, print, or share the filled form as needed.

Complete your P11d B Form 2019 20 Pdf online today to ensure timely and accurate filing.

To submit a P11DB, ensure you have correctly filled out all required fields on the form. The electronic submission process can be done via HM Revenue and Customs’ online services, which may include uploading the P11D B Form 2019 20 Pdf. If you need guidance, consider using uslegalforms platform, which provides useful resources to navigate the submission steps.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.