Loading

Get 0619e Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 0619e Form online

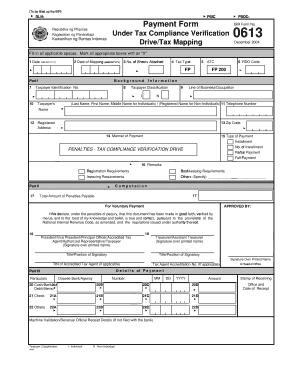

Filling out the 0619e Form online requires attention to detail and accuracy. This guide provides a step-by-step approach to ensure you complete the form correctly, helping you navigate through each section with ease.

Follow the steps to successfully complete the 0619e Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the date in MM/DD/YYYY format in the field designated for the date at the top of the form.

- Fill in the date of mapping using the same MM/DD/YYYY format in the next field.

- Indicate the number of sheets attached if applicable in the corresponding field.

- Select the tax type from the options provided in the available field.

- Complete the taxpayer identification number (TIN) and the RDO code accurately.

- Provide the taxpayer's full name or registered name if a non-individual, ensuring the last name, first name, and middle name is filled out as required.

- Fill in the telephone number and registered address including the zip code.

- Choose the manner of payment and specify the type of payment (partial or full) and the number of installments if applicable.

- In the remarks section, indicate any registration, bookkeeping, or invoicing requirements that are needed.

- Calculate and enter the total amount of penalties payable for voluntary payment in the computation section.

- Ensure the signature of the authorized signatory is added along with their printed name and designated title.

- At this point, review all entries for accuracy, then save the changes. Users can download, print, or share the form if needed.

Complete your documents online to ensure a hassle-free submission process.

To process your eFPS, first ensure you are registered on the eFPS portal. Login, navigate to the appropriate form you need, such as the 0619e Form, and follow on-screen instructions to file your taxes electronically. Always double-check your entries to avoid errors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.