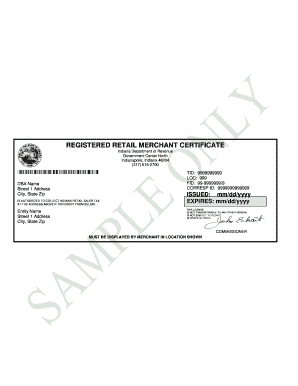

Get Retail Merchant Certificate Indiana 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Retail Merchant Certificate Indiana online

Filling out the Retail Merchant Certificate in Indiana is a vital step for businesses that wish to collect retail sales tax. This guide provides clear and concise instructions on completing the form online, ensuring you have the necessary information to support your application.

Follow the steps to complete your Retail Merchant Certificate

- Click ‘Get Form’ button to access the form and open it for editing.

- Enter the 'DBA Name', which is the name under which your business operates. This should match the name you use for marketing and sales.

- Fill in the 'Street 1 Address', providing the primary location where retail sales occur. Make sure the address is accurate to avoid any processing delays.

- Input the 'City, State, Zip' information relevant to the address you provided in the previous step. This ensures proper identification of your business location.

- If the address where sales occur differs from the one entered before, complete the alternate address section, including the 'Entity Name', 'Street 1 Address', and 'City, State, Zip'.

- Take note of the 'Issued' and 'Expires' dates. These will be pre-printed fields that indicate when the certificate is effective and when it will need renewal.

- Review the license stipulations, which state that this license is not transferrable to another person, is not subject to rebate, and will void if altered. Confirm your understanding of these conditions.

- Check that all information is accurate and complete before saving your changes. After ensuring everything is correct, you can download, print, or share the completed form as needed.

Complete your Retail Merchant Certificate online today to ensure your business complies with Indiana retail sales tax regulations.

To obtain a Taxpayer Identification Number (TID) in Indiana, you need to register your business with the Indiana Department of Revenue. You can do this online or by submitting a paper application. Services such as US Legal Forms can help simplify the registration process, ensuring you receive your TID efficiently.

Fill Retail Merchant Certificate Indiana

You can register to collect sales tax and obtain a Registered Retail Merchant Certificate (RRMC) via InBiz. Upon registration for retail sales tax, the Department will issue a Registered Retail Merchant Certificate. You can fill out a paper application online at BT-1 Paper Application . To obtain a Registered Retail Merchant Certificate (RRMC) in Indiana, you'll need to go through the state's online portal, INBiz. Obtaining a Retail Merchant Certificate requires you to collect sales tax for eligible sales in Indiana. Confirm registration requirements, gather info, then register on INTIME. Stripe can register on your behalf. You'll need EIN, business info, NAICS, and start date. To get an Indiana resale certificate, first apply for a Registered Retail Merchant Certificate, then complete the ST-105 form. You can easily acquire your Indiana Registered Retail Merchant Certificate (RRMC) online using the Indiana Department of Revenue website.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.