Loading

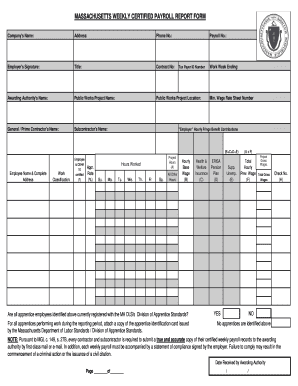

Get Massachusetts Certified Payroll Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Massachusetts Certified Payroll Form online

Filling out the Massachusetts Certified Payroll Form correctly is essential for compliance with state labor laws. This guide will provide you with a step-by-step approach to completing the form online, ensuring all required information is accurately reported.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your company’s name along with the address and phone number in the designated fields. This information identifies the entity completing the form.

- Fill in the payroll number, contract number, and the name of the awarding authority. This data connects your payroll report to the relevant contract and project.

- Provide the public works project name and location. This specifies the project for which the payroll is being submitted.

- In the appropriate section, enter the name of the general or prime contractor, followed by the subcontractor’s name if applicable.

- Enter your tax payer ID number, which is necessary for tax identification purposes.

- Indicate the work week ending date and reference the minimum wage rate sheet number to ensure compliance with wage laws.

- For each employee, list their complete name and address in the respective fields. It is important to ensure this information is accurate.

- Input the work classification for each employee, noting whether they are OSHA 10 certified by selecting 'Yes' or 'No'.

- Fill out the agreed upon hourly rate and the project hours worked during the week. Document hours worked each day of the week.

- Include any other hours worked, if applicable, alongside the hourly base wage for each employee.

- Provide details about fringe benefit contributions and any supplemental unemployment that may apply. These figures will affect the total hourly wages.

- Determine if all apprentice employees are registered with the MA DLS's Division of Apprentice Standards, and attach the required identification cards.

- Verify the total gross wages for all employees and the accompanying paycheck number if applicable.

- After ensuring all information is accurate, save the changes, download the completed form, and consider printing or sharing it as necessary.

Complete your Massachusetts Certified Payroll Form online to ensure timely compliance!

Certified payroll in California requires contractors to complete and submit payroll reports that reflect the wages and hours of workers. These reports must be submitted weekly, ensuring accurate tracking of labor costs on public works projects. By using the Massachusetts Certified Payroll Form, you clarify your compliance efforts and maintain accurate records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.