Loading

Get Inventory Of Unused Official Receipts 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Inventory Of Unused Official Receipts online

This guide will provide you with step-by-step instructions on how to accurately complete the Inventory Of Unused Official Receipts form online. Follow these instructions to ensure that your information is correctly submitted.

Follow the steps to complete the form efficiently.

- Click the ‘Get Form’ button to access the Inventory Of Unused Official Receipts. This will open the form in your online editor, allowing you to begin filling out the necessary information.

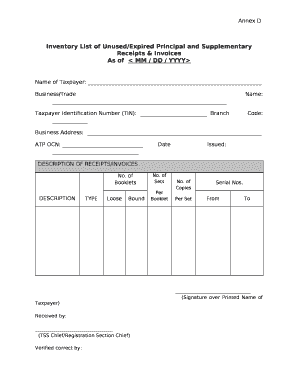

- In the first section, enter the name of the taxpayer. This field is essential for identifying the entity submitting the inventory. Make sure to write the full legal name.

- Next, provide the business or trade name if it differs from the taxpayer's name. This helps clarify the nature of the activities being reported.

- In the Taxpayer Identification Number (TIN) field, enter the unique identification number assigned to the taxpayer. Ensure this number is accurate to avoid delays.

- Complete the business address section with the physical location of the business. An accurate address is crucial for correspondence related to the inventory.

- Record the ATP OCN (Authority to Print Official Receipts) number in the designated area. This number is necessary for validating the official status of the receipts.

- In the description of receipts/invoices section, list each receipt or invoice you are inventorying. For each receipt, you should enter the number of booklets, the type (loose/bound), the number of sets per booklet, the number of copies per set, and the serial numbers from and to.

- After filling out all fields, carefully review the form for accuracy. Ensure all entries meet the required standards and information is complete.

- Once verified, you can save your changes. Options will be available to download, print, or share the completed Inventory Of Unused Official Receipts form as needed.

Complete your documents online today to manage your receipts efficiently.

The term inventory received refers to the quantity of goods that have been accepted into your stock. This involves accurate documentation, including receipts that verify the transaction. Keeping track of what inventory you have received will help you manage the inventory of unused official receipts effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.