Get Pru Life Suitability Assessment Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pru Life Suitability Assessment Form online

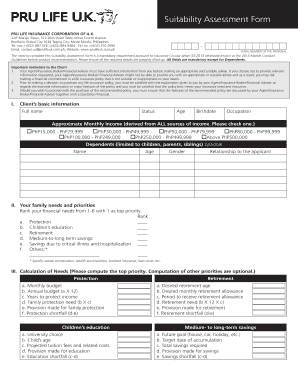

Completing the Pru Life Suitability Assessment Form is an essential step before making a life insurance policy recommendation. This guide provides a clear, step-by-step approach to filling out the form online, ensuring that you provide all necessary information accurately.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the Client’s Basic Information section. Fill in your full name, status, age, birthdate, occupation, and approximate monthly income by selecting the appropriate income bracket.

- If applicable, complete the Dependents section by providing the name, age, gender, and relationship of any dependents.

- Move to the Your Family Needs and Priorities section. Rank your financial needs from 1 to 6, where 1 represents your top priority.

- Proceed to the Calculation of Needs section. Focus on your top priority first and complete the calculations as prompted, noting any provision made and identifying any shortfalls.

- Fill out the Record of Advice section, indicating the recommended policies, core benefits, and the type of plan selected for each recommended policy.

- In the Product Suitability Assessment section, list the priority needs identified and the premium commitment you are willing to make.

- Complete the Risk Profiler section if you are considering a variable or unit-linked product. Answer the questions based on your investment preferences.

- Review your responses in the Fund Suitability Assessment and ensure that you select the appropriate funds based on your risk profile.

- Finalize by reviewing all sections for accuracy. If everything is correct, you can save changes, download, print, or share the form.

Start filling out your Pru Life Suitability Assessment Form online today to ensure you receive the most suitable insurance recommendations.

The suitability analysis of life insurance assesses your financial situation and needs to determine the best coverage for you. It takes into account factors such as your income, family status, and long-term goals. Completing the Pru Life Suitability Assessment Form can make this process easier, as it provides essential insights into the right life insurance options for you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.