Loading

Get 4506 T March 2019 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 4506 T March 2019 online

The 4506 T March 2019 form is used to request a transcript of your tax return from the Internal Revenue Service. Filling out this form online can be straightforward, provided you follow the necessary steps carefully.

Follow the steps to correctly fill out the 4506 T March 2019 online.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Carefully fill out line 1a with your name as it appears on your tax return; if you filed a joint return, list the first name.

- Enter the first social security number or employer identification number associated with the tax return in line 1b.

- If applicable, complete line 2a with your spouse's name if filing a joint return.

- Input the second social security number associated with the joint return in line 2b, if relevant.

- In line 3, provide your current mailing address including any apartment or suite number, followed by the city, state, and ZIP code.

- If you have a different address from your last tax return, fill it in line 4.

- If you need to send the transcript to a third party, complete line 5a with their name, address, and phone number.

- If applicable, enter a customer file number on line 5b to help identify your request in the future.

- Select the type of transcript requested and fill out line 6, noting the specific tax form number.

- Complete line 7 if you need verification of non-filing status for a specific tax year.

- Specify the year or period for which you are requesting the transcript on line 9, using the mm/dd/yyyy format.

- Sign and date the form in the designated area, ensuring that all necessary lines are filled out.

- Upon completion, you may save changes, download, print, or share the form as needed.

Get started on your 4506 T March 2019 submission online today!

Related links form

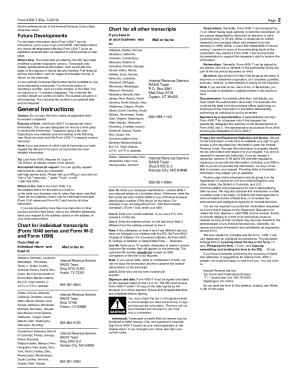

To submit Form 4506-T, you have a couple of options. You can mail it to the appropriate address listed on the form, or you can fax it to your local IRS office if that’s specified for your request type. Using the 4506 T March 2019 form, just be sure all required fields are complete to avoid delays in processing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.