Loading

Get Equi Vest Disbursement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Equi Vest Disbursement Form online

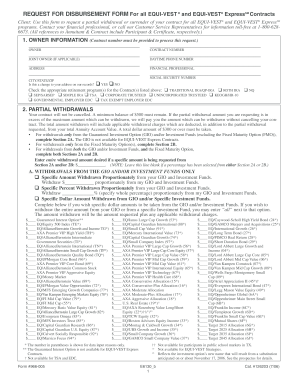

The Equi Vest Disbursement Form is an essential document for users seeking to request a partial withdrawal or surrender of their contract. Filling out this form correctly ensures a smooth processing of your request.

Follow the steps to complete the Equi Vest Disbursement Form online.

- Press the ‘Get Form’ button to obtain the Equi Vest Disbursement Form and open it in your preferred online editing tool.

- Begin by providing the owner information. Fill in the Contract number, Joint Owner (if applicable), Daytime phone number, and Address. Ensure that the Financial Professional's contact information is also included.

- Indicate whether there is a change of address on your records by ticking 'Yes' or 'No'.

- Select the appropriate retirement program(s) that correspond to the contract number you provided. Options include Traditional IRA, Roth IRA, and others. Be sure to check all that apply.

- If requesting a partial withdrawal, specify the amount desired in Section 2A for Guaranteed Investment Option and/or Investment Funds. You must ensure that you leave the line blank if indicating a percentage.

- Complete Section 2B if you are requesting withdrawals from Fixed Maturity Option(s). Clearly state the amount or percentage you wish to withdraw from the specified periods.

- For those who have a spouse, complete the spousal consent requirement if applicable. Sign and ensure the statement is witnessed by a Notary Public.

- Complete the important tax notification section by indicating your preference for federal income tax withholding. Be mindful of the options provided and make selections accordingly.

- Review your information carefully for accuracy, then finalize your request by signing the form. Include the date next to your signature.

- Once you have filled out the entire form, you can save your changes, download, print, or share the form as needed.

Begin filling out your Equi Vest Disbursement Form online today for a seamless disbursement process.

Equi Vest and Equitable are related but not identical. Equi Vest refers specifically to the investment and insurance products offered by Equitable, which includes annuities and related services. Understanding the distinct features of each can aid you in making informed decisions, and the Equi Vest Disbursement Form can provide clarity on your options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.