Loading

Get W7 Pdf 2020-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W7 Pdf online

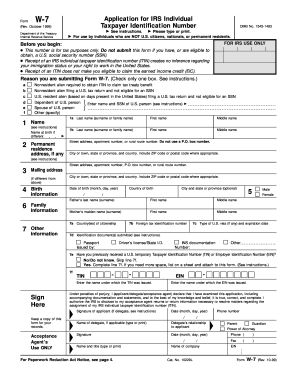

Filling out the W7 Pdf, which is the application for an IRS individual taxpayer identification number (ITIN), is a straightforward process that can be completed online. This guide provides clear, step-by-step instructions to help you navigate each section of the form, ensuring that your application is completed accurately and efficiently.

Follow the steps to complete the W7 Pdf online.

- Click ‘Get Form’ button to obtain the W7 Pdf and open it in your preferred online editor.

- Review the information on the form. Begin filling out your reason for submitting the W7 by checking only one box. Options include: (a) nonresident alien seeking ITIN for tax treaty benefit, (b) nonresident alien filing a U.S. tax return without an SSN, (c) U.S. resident alien filing a tax return without an SSN, (d) dependent of a U.S. person, (e) spouse of a U.S. person, or (f) other (please specify).

- Proceed to section 1 to enter your legal name in the relevant fields. Input your last name, middle name, and first name. If your name at birth is different, enter it in the designated field.

- Complete section 2 by providing your permanent residence address. Include the street address, city, state or province, country, and ZIP or postal code. Avoid using a P.O. box.

- If applicable, fill in section 3 with your mailing address, which may differ from your permanent address.

- In section 4, provide your birth information including the city and country of birth as well as your date of birth.

- Complete section 5 with your family information, entering your father's last name and mother's maiden name.

- In section 6, list the countries of citizenship and any foreign tax identification number you have.

- In section 7, detail any U.S. visa you hold and its expiration date. Indicate the identification documents you are submitting for verification.

- If you have previously received a temporary taxpayer identification number (TIN) or employer identification number (EIN), indicate this in line 7e and complete line 7f as necessary.

- Sign the form to confirm the information is accurate. If you are completing the form on behalf of someone else, include your relationship to them.

- Once completed, save your changes, download a copy if needed, and consider printing or sharing the form as required.

Complete your documents online with confidence, ensuring you follow each step carefully.

Renewing your ITIN number requires submitting a new W7 Pdf form to the IRS. You need to gather supporting documents to prove your identity and foreign status. Submit your application as soon as you realize your ITIN has expired. This timely action ensures you maintain compliance with tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.