Loading

Get W 9 Form Printable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W 9 Form Printable online

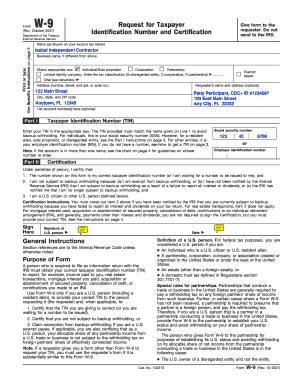

Filling out the W 9 Form Printable is essential for providing your taxpayer identification number to the requesting party. This guide offers a straightforward approach to complete the form online, ensuring accuracy and compliance with IRS guidelines.

Follow the steps to complete the W 9 Form Printable online.

- Press ‘Get Form’ button to access the W 9 Form Printable and open it in your preferred online editor.

- Fill in your name exactly as it appears on your income tax return on the first line. If you're using a business name, enter it on the next line.

- Check the box that applies to your status, whether individual/sole proprietor, corporation, partnership, limited liability company, or other.

- Provide your complete address, including street, apartment or suite number, city, state, and ZIP code.

- Enter your taxpayer identification number (TIN) in Part I. For individuals, this is your social security number (SSN). For other entities, provide your employer identification number (EIN).

- In Part II, certify that the information provided is accurate by signing and dating the form. Ensure to read the certification statements thoroughly.

- If applicable, check the ‘Exempt payee’ box and complete the relevant sections based on your tax-exempt status.

- After reviewing your entries for accuracy, save the completed form, then download, print, or share as needed.

Secure your W 9 Form Printable and fill it out online today.

The best way to get a W 9 Form Printable is to visit reputable websites that offer government forms, such as the IRS site or U.S. Legal Forms. These sources provide the most up-to-date version of the W9 form that you need. By downloading it from a trusted platform, you ensure you have the correct form for your tax purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.