Get Formulario 499 R 4 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulario 499 R 4 online

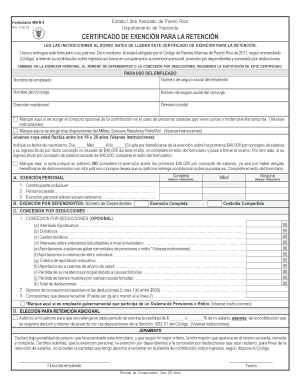

Formulario 499 R 4 is a vital document that allows employees in Puerto Rico to inform their employers of their personal exemptions, dependent exemptions, and deduction allowances for income tax purposes. This guide provides clear and concise instructions to assist users in completing the form online.

Follow the steps to successfully fill out the Formulario 499 R 4 online.

- Press the ‘Get Form’ button to access the Formulario 499 R 4 and open it in your preferred editor for online completion.

- Begin by providing your personal details in the header section, including your name, social security number, residential address, and postal address. If applicable, also include the name and social security number of your partner.

- Indicate if you are opting for the optional computation for contributions for married individuals living together and filing a joint return by marking the designated box.

- For young individuals aged 16 to 26, enter your date of birth. If your gross income from salaries does not exceed $40,000 annually, you can skip the rest of the form and proceed to sign it.

- In Part A, select the appropriate box to indicate your personal exemption. Choices include: 'No exemption', 'Complete exemption', or 'Half exemption' if married.

- In Part B, indicate the number of dependents you wish to claim for the exemption. Include separate entries for dependent children under shared custody.

- Complete Part C by providing details of any deductions you are entitled to claim. List the types of deductions in the space provided and ensure they match the limits specified.

- In Part D, if you want your employer to withhold an additional amount from your pay, specify the amount or percentage you authorize for extra withholding.

- Finish by signing the form, affirming that the information provided is accurate. Include the date of signing.

- Once completed, save your changes, and choose to download, print, or share the Formulario 499 R 4 as required.

Start completing your Formulario 499 R 4 online today to ensure your tax obligations are accurately managed.

Form 499R 2 w 2pr is a form used in Puerto Rico for reporting wages and tax withholdings. This form provides crucial information about an employee’s income and the taxes that have been withheld throughout the year. Understanding this form is vital for maintaining accurate tax records, especially when paired with other forms like Formulario 499 R 4.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.