Loading

Get Sba Form 2202 Example 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sba Form 2202 Example online

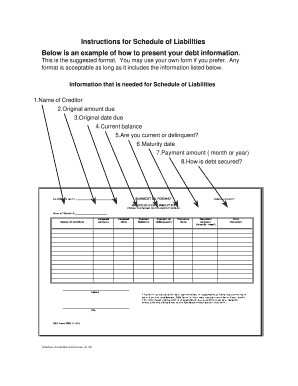

Filling out the Sba Form 2202 Example correctly is essential for managing your liabilities effectively. This guide provides clear instructions on each section of the form to ensure you can complete it with confidence.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and access it in the editor.

- Begin by entering the name of the creditor in the designated field. Ensure the name is spelled correctly as it is essential for identification.

- Provide the original amount due, which reflects the total debt before any payments have been made. This amount should correspond to the initial borrowed funds.

- Input the original date due, indicating when the debt was initially expected to be paid. This helps track the timeline of your liabilities.

- Fill in the current balance, which is the amount still owed on this debt as of today. Update this figure to reflect any payments made or interest accrued.

- Indicate whether you are current or delinquent on the debt. This information helps to clarify your payment status.

- Enter the maturity date of the loan, which is the final date by which the debt must be repaid in full.

- Specify the payment amount and frequency, noting whether it is monthly or annually. This outlines your repayment obligations.

- Describe how the debt is secured in the appropriate section. This could include collateral or other guarantees related to the loan.

- After reviewing all entries for accuracy, you can save your changes, download the form for your records, print it for submission, or share it as needed.

Complete your documents online today to ensure all your liabilities are accurately reported.

The schedule of liabilities should detail all your financial obligations, including both short-term and long-term debts. You should include categories like personal loans, credit cards, and mortgages, specifying amounts and due dates. This schedule plays a crucial role in providing lenders with an accurate financial overview. The SBA Form 2202 Example can guide you in preparing this schedule efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.