Loading

Get Ct 706 Nt 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 706 Nt online

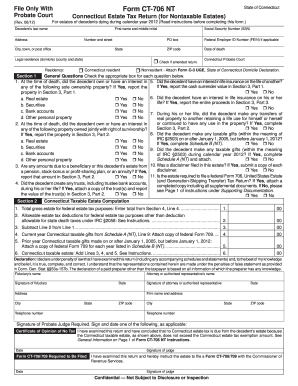

The Ct 706 Nt is the Connecticut Estate Tax Return for nontaxable estates, which is necessary for reporting the estate's value and ensuring compliance with state tax laws. This guide provides clear instructions on how to effectively fill out this form online, making the process easier for all users.

Follow the steps to complete the Ct 706 Nt form online:

- Press the ‘Get Form’ button to access the form, ensuring it opens in your preferred editing platform.

- Begin by entering the decedent's last name, first name, middle initial, and complete address including any PO box and ZIP code. Provide the county and state of legal residence.

- Input the Social Security number (SSN) and Federal Employer ID Number (FEIN) if applicable.

- Record the date of death of the decedent.

- Indicate whether this is an amended return and select the residency status of the decedent (Connecticut resident or nonresident). If nonresident, ensure to attach Form C-3 UGE.

- Proceed to Section 1 by checking 'Yes' or 'No' for each general question regarding the decedent's ownership of property and interests, ensuring to follow instructions for reporting where applicable.

- Move to Section 2 and calculate the Connecticut taxable estate by entering figures as instructed, ensuring that the totals are correctly calculated from previous sections.

- In Section 3, detail all property and proceeds reported for federal estate tax purposes according to the specified categories: solely-owned property, jointly-owned property, and life insurance proceeds.

- Complete Section 4 by summing the total gross estate as it would be valued for federal estate tax purposes.

- Finalize the document with signatures from the fiduciary and the attorney or authorized representative where applicable.

- Once completed, functionalities to save changes, download, print, or share the form will be available for your convenience.

Complete the Ct 706 Nt form online to ensure accurate estate tax reporting.

After 2025, the discussion around DSUe will become more relevant as tax laws evolve. It is important to stay informed on changes that may affect estate planning and taxation. Resources like uslegalforms keep you updated with the latest information, ensuring you make well-informed decisions moving forward.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.