Loading

Get Form 10193 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 10193 online

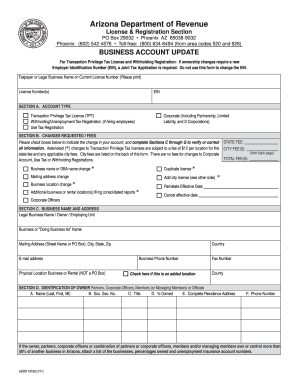

Filling out the Form 10193 online can streamline your business account updates for transaction privilege tax licenses and withholding registrations. This guide will lead you through each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete the Form 10193 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin with Section A where you will select the account type that applies to your business. Options include corporate, transaction privilege tax license, withholding/unemployment tax registration, or use tax registration.

- In Section B, indicate the changes requested by checking the appropriate boxes. You will need to complete Sections C through G to verify or correct the information as needed. Be aware of any associated fees for specific changes.

- Proceed to Section C to fill out the legal business name or owner name, your 'Doing Business As' name, mailing address, email address, physical location, and phone number.

- In Section D, provide identification details of ownership. This includes name, social security number, title, ownership percentage, and complete residence address for partners, corporate officers, members, or officials.

- Section E requires the location of your tax records, including the street address, city, state, and ZIP code, along with the contact person’s name and phone number.

- Fill out Section F by listing any applicable program city transaction privilege tax license fees for the affected cities. Adjust numbers for locations as necessary.

- Lastly, ensure to complete Section G by signing and dating the form. This signature certifies that all information provided is true and correct under penalty of perjury.

- Once you have reviewed all sections for accuracy, you can save changes, download the completed form, print it, or share it as needed.

Complete your Form 10193 online today to ensure your business account remains up-to-date.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To close an Arizona withholding account, you must notify the Arizona Department of Revenue. This often involves completing related paperwork, possibly including Form 10193. Using uslegalforms can simplify your experience, as they offer templates and expert guidance to help you navigate the closure process effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.