Loading

Get Ncui 604 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ncui 604 online

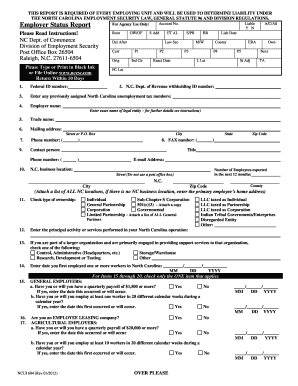

Completing the Ncui 604 form is an essential step for employers in North Carolina to determine their liability under employment security laws. This guide provides a detailed, step-by-step process to help you fill out this form accurately and efficiently.

Follow the steps to successfully complete your Ncui 604 form.

- Click ‘Get Form’ button to obtain the Ncui 604 form and open it in the editor.

- Fill in the federal ID number in the designated field. Make sure to provide the correct number as this is crucial for your employer identification.

- Input your N.C. Dept. of Revenue withholding ID number if applicable. This helps to streamline your tax reporting.

- Enter any previously assigned North Carolina unemployment tax numbers if you have them. This ensures all your records are linked accurately.

- Provide the legal entity name of your business exactly as it appears on official documents.

- Specify your trade name, if it differs from your legal name, in the appropriate field.

- Fill out your mailing address completely, ensuring it includes street or P.O. Box, city, state, and zip code.

- Enter your phone number and FAX number, alongside the name and title of your contact person.

- Detail the N.C. business location with a street address (a P.O. Box is not acceptable) and provide the expected number of employees in the next 12 months.

- Indicate the type of ownership of your business by checking the appropriate box.

- Describe the principal activity or services your business offers in North Carolina.

- If applicable, check the box that corresponds to your role within a larger organization.

- Record the date when you first employed workers in North Carolina in the MM/DD/YYYY format.

- Answer the questions regarding general and agricultural employer status, providing dates as required.

- If applicable, complete the section regarding any changes in business ownership and self-employed individuals.

- Review your entries for accuracy before signing to certify that the information is true and that you are authorized to submit the form.

- Once completed, you can save the changes, download the form, print it for your records, or share it as needed.

Ensure you complete your Ncui 604 form online to fulfill your employment security obligations.

To obtain an unemployment tax number in North Carolina, you will need to register as an employer with the NC Division of Employment Security. Fill out the necessary forms, ensuring all details are precise and complete. This employment registration process is crucial for your Ncui 604 needs and will support your business's compliance with tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.