Loading

Get Credit Reference 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Credit Reference online

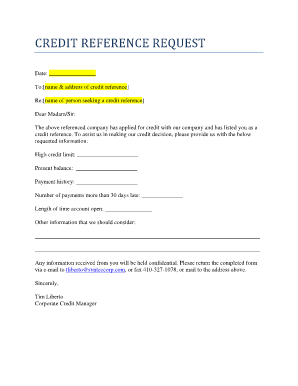

This guide provides a step-by-step process for completing the Credit Reference form online. By following these instructions, you can efficiently provide the necessary information requested for a credit reference.

Follow the steps to complete the Credit Reference form.

- Press the ‘Get Form’ button to obtain the Credit Reference form and open it in your preferred editor.

- Fill in the date at the top of the form. This should be the current date on which you are completing the form.

- In the section labeled 'To:', provide the name and address of the credit reference you are contacting.

- Next, in the 'Re:' section, enter the name of the person who is seeking the credit reference.

- In the body of the letter, clearly state the request for information regarding the company that has applied for credit. You may want to briefly introduce the context.

- Complete the fields for the requested information: fill in the high credit limit, present balance, payment history, number of payments more than 30 days late, and length of time the account has been open.

- If there is additional information that should be considered, use the provided space to elaborate on any relevant details.

- Once all fields are filled out, review the form for accuracy and completeness.

- Save your changes. You can then choose to download, print, or share the completed form as needed.

Complete your Credit Reference form online and enhance your credit decision process.

Your credit reference refers to any document or individual that provides insights into your credit history. This can include credit reports, bank statements, or letters from creditors. Understanding your credit reference ensures you present yourself accurately when seeking new credit opportunities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.