Get Maryland First Time Home Buyer Addendum

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Maryland First Time Home Buyer Addendum online

How to fill out and sign Maryland First Time Home Buyer Addendum online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Engaging a legal professional, scheduling a meeting, and visiting the office for a face-to-face consultation makes completing a Maryland First Time Home Buyer Addendum from beginning to end demanding.

US Legal Forms enables you to quickly create legally binding documents using pre-formulated online templates.

Quickly generate a Maryland First Time Home Buyer Addendum without needing to consult experts. Over 3 million users are already benefiting from our extensive collection of legal forms. Join us now and gain access to the premier collection of online samples. Experience it yourself!

- Obtain the Maryland First Time Home Buyer Addendum you require.

- Access it with a cloud-based editor and begin making changes.

- Fill in the blanks; names, addresses, phone numbers, etc.

- Personalize the template with distinct fillable sections.

- Add the date and affix your electronic signature.

- Click on Done after carefully reviewing everything.

- Save the completed document to your computer or print it as a physical copy.

How to Alter Get Maryland First Time Home Buyer Addendum: Personalize Forms Online

Utilize our sophisticated editor to convert a basic online template into a finalized document. Keep reading to discover how to easily alter Get Maryland First Time Home Buyer Addendum online.

Once you find a suitable Get Maryland First Time Home Buyer Addendum, all you need to do is modify the template to fit your requirements or legal stipulations. Besides filling in the printable form with precise information, you may have to eliminate certain clauses in the document that do not pertain to your situation. Alternatively, you may desire to incorporate any absent terms in the initial form. Our advanced document editing capabilities are the ideal way to amend and adjust the form.

The editor enables you to alter the content of any form, even if the file is in PDF format. It is feasible to add and delete text, insert fillable fields, and make additional modifications while preserving the original layout of the document. You can also rearrange the form's structure by changing the order of pages.

You don’t need to print the Get Maryland First Time Home Buyer Addendum to endorse it. The editor is equipped with electronic signature functionalities. Most forms already include signature fields, so you just need to place your signature and request one from the other signing party via email.

Follow this detailed guide to generate your Get Maryland First Time Home Buyer Addendum:

Once all parties sign the document, you will get a signed copy which you can download, print, and distribute to others.

Our solutions allow you to save a significant amount of time and minimize the potential for errors in your documents. Enhance your document processes with effective editing features and a robust eSignature solution.

- Open the chosen form.

- Utilize the toolbar to modify the form to your liking.

- Fill in the form with accurate information.

- Click on the signature field and insert your electronic signature.

- Send the document for signature to additional signers if necessary.

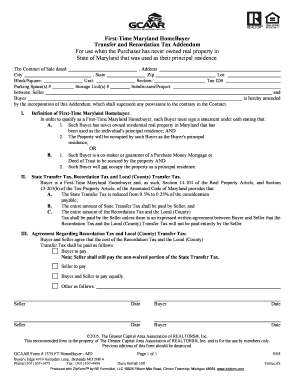

The first-time homebuyer tax in Maryland refers to tax benefits available to individuals purchasing their first home. It often involves claiming the mortgage interest deduction, which can lead to reduced tax liabilities. Familiarizing yourself with these tax implications can help you make informed decisions. The Maryland First Time Home Buyer Addendum may include relevant tax credit information to streamline this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.