Loading

Get Nebraska Form 6 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska Form 6 online

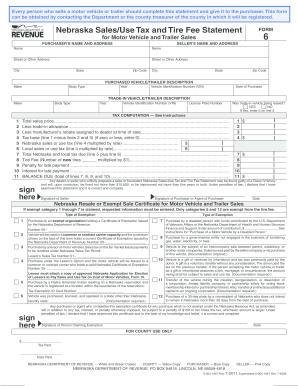

Filling out the Nebraska Form 6 online is a crucial step for anyone selling a motor vehicle or trailer. This guide will provide you with clear instructions on how to accurately complete each section of the form to ensure a smooth filing process.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the purchaser’s name and address. Make sure to fill in all required fields accurately, including street address, city, state, and zip code.

- In the purchased vehicle/trailer description section, provide the make, body type, year, vehicle identification number (VIN), and date of purchase for the vehicle being sold.

- In the tax computation section, accurately calculate the total sales price and proceed to fill in the allowances and rebates, ensuring that you follow the outlined instructions for each line carefully.

- Ensure to sign the form where indicated, specifying the signatures of both the seller and purchaser or their agents.

- Review all entered information for accuracy before saving your changes. You can then download, print, or share the completed form as required.

Complete your documents online with confidence and ease!

To send your state tax return in Nebraska, you should mail it to the Nebraska Department of Revenue. Make sure you double-check the mailing address on their official website, as it can vary based on the type of return you are submitting. Sending your return to the correct address ensures it gets processed promptly. Always consider using USLegalForms for organized tax filing to streamline this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.