Loading

Get Montana W 9 Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Montana W 9 Form online

Filling out the Montana W 9 Form online can streamline your document submission process and ensure compliance with tax regulations. This guide provides step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Montana W 9 Form online.

- Click ‘Get Form’ button to access the Montana W 9 Form for completion. This will allow you to obtain the necessary document in a digital format.

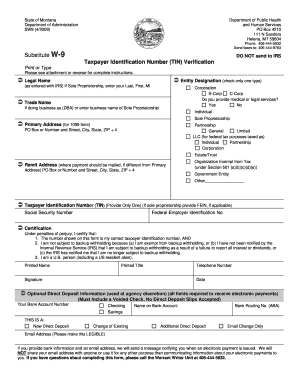

- Begin by filling in your legal name as registered with the IRS. If you are a sole proprietorship, include your last name, first name, and middle initial.

- Select the appropriate entity designation by checking only one box that applies to your situation, such as Corporation, S-Corp, or Sole Proprietorship.

- Indicate whether you provide medical or legal services by selecting 'Yes' or 'No'.

- If applicable, enter your Trade Name or 'Doing Business As' (DBA) name in the designated field.

- Provide your primary business address where the 1099 Form should be mailed. Include your PO Box or street address, city, state, and ZIP code.

- If your remit address (where payment should be sent) is different from your primary address, fill out the remit address fields accordingly.

- Enter your Taxpayer Identification Number (TIN), which can be either your Social Security Number or Federal Employer Identification Number. Ensure you provide only one type of number.

- Carefully read and certify the statement under penalties of perjury, verifying that the provided TIN is correct and that you meet the requirements outlined.

- Complete the printed name, title, telephone number, signature, and date fields to finalize the form.

- If applicable, provide optional direct deposit information by filling out the required bank account details, including account number and bank routing number.

- Once all sections are filled out, review the form for accuracy, then save your changes, and choose to download, print, or share the completed form as needed.

Get started on completing your documents online for a seamless process.

If you need a copy of your W9 form, the best approach is to reach out to the person or organization that you submitted it to. They should have a record of the Montana W 9 Form you provided. If they do not have it, you can easily recreate the form using templates available online, or utilize services like USLegalForms which offer guided assistance in generating the correct document.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.